Navigating cost pressures in Indonesia’s upstream oil and gas industry

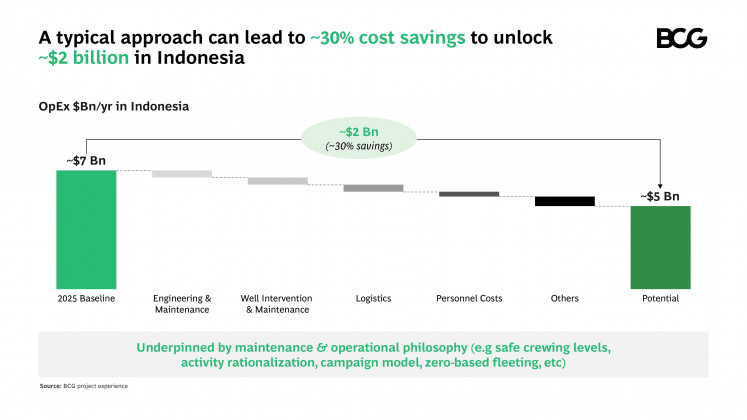

Boston Consulting Group estimates that Indonesia's upstream energy sector could achieve substantial cost savings of up to 30 percent, or approximately US$2 billion, through comprehensive performance improvement measures, while maintaining or even enhancing production, asset integrity and HSE performance.

Change text size

Gift Premium Articles

to Anyone

Locals fish in shallow water near an oil refinery belonging to state-owned oil and gas giant Pertamina in Cilacap, Central Java in this file photo. (The Jakarta Post/Agus Maryono)

Locals fish in shallow water near an oil refinery belonging to state-owned oil and gas giant Pertamina in Cilacap, Central Java in this file photo. (The Jakarta Post/Agus Maryono)

I

ndonesia’s upstream oil and gas sector is facing mounting challenges. Production is in decline, costs are rising and future growth depends on increasingly complex fields.

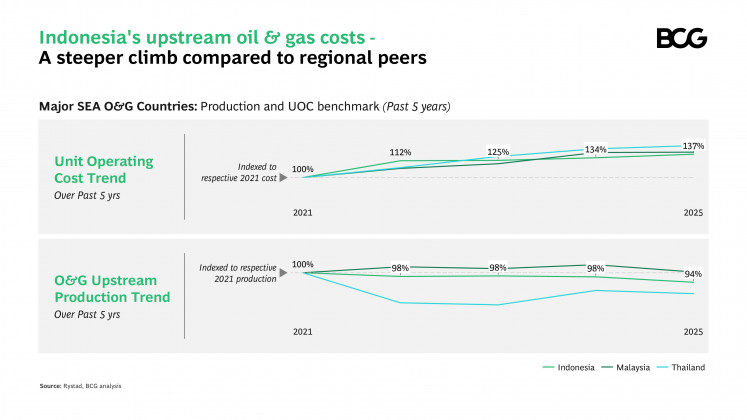

Over the past five years, domestic output has fallen by around 6 percent, from 1.77 million barrels of oil equivalent per day (boepd) to 1.67 million boepd, while unit operating costs have surged by around 37 percent. Among the three major Southeast Asian producers experiencing cost increases, Indonesia has seen the highest rise over this period. Despite these pressures, the Indonesian government has set an ambitious target to produce 1 million barrels of oil per day (bopd) and 12 billion cubic feet per day (bcfpd) of gas by 2030, pushing operators to explore and develop fields in harsher and more challenging environments.

With over 70 percent of national output today coming from mature fields, and most new developments facing high CO₂ levels, or deepwater challenges, sustaining and expanding production will demand bold innovation, improved cost efficiency and increased operational resilience. The industry must act decisively to remain competitive, attract investment and secure Indonesia’s energy future.

The value of efficiency: Unlocking $2 billion in savings

The cost and performance pressures the Indonesian oil and gas industry faces are compounded by inflation, supply chain disruptions and the needs of energy transition. However, this is an industry well-versed in cost optimization.

Now it is time for the next step. Boston Consulting Group (BCG) estimates that Indonesia's upstream energy sector could achieve substantial cost savings of up to 30 percent, or approximately US$2 billion, through comprehensive performance improvement measures, while maintaining or even enhancing production, asset integrity and HSE performance.

BCG’s recent report, “Upstream Energy Companies Cut Costs. Can They Sustain the Results?”, highlights three pathways for upstream energy companies to achieve sustainable cost reduction: no-regret moves, structural changes and disruptive changes.

No-regret moves focus on quick efficiency improvements within existing operating model constraints, delivering cost savings of 10-15 percent. These measures include optimizing logistics by adjusting vessel and helicopter schedules, reducing the use of consumables such as chemicals, streamlining workflows to increase productive time, eliminating lower-risk maintenance tasks and renegotiating contractor agreements to improve spend efficiency.

Structural changes involve more complex shifts in operating philosophy and ways of working to enhance productivity, reduce costs and improve production, with the potential to deliver cost savings of up to 15-30 percent. Key strategies include optimizing staffing through fit-for-purpose site manning and lean offsite support, simplifying and improving workflows, and outsourcing to lower-cost providers.

Disruptive changes require a fundamental shift in operating model and adoption of innovative business models, unlocking cost savings of over 30 percent while maintaining or enhancing production. For example, maximizing value from Indonesia’s mature fields could involve strategic partnerships with specialist mature field operators or the creation of a dedicated entity focused on mature fields, an approach successfully adopted in the UK and Norway to maximize value from mature and marginal fields.

Making cost cuts stick

Sustaining cost reductions requires a systematic, integrated approach. Based on global best practices, we have identified six strategies that can help Southeast Asia’s upstream operators achieve lasting improvements:

Understanding and improving how work gets done at the front line. It is crucial for companies to genuinely grasp how work is delivered onsite before designing the changes that can improve efficiency and effectiveness on a continuing basis.

Challenging ‘accepted and tested’ standards and practices. Management needs to challenge standards that have acquired “gold-plated” status in the name of risk mitigation, especially when the asset’s remaining economic life does not merit the associated expenditures.

Fostering interdisciplinary collaboration and skill sets. Upstream oil and gas workflows need diverse capabilities, improvements demand a multidisciplinary approach. Teams need aligned KPIs, collocation and agile ways of working to ensure that they work toward common goals and enhance operational synergy.

Developing a ‘bias for value’ at all levels of the organization. Cost performance should be top of mind. Companies can encourage the development of a value-oriented culture by ensuring that every level of the organization contributes to the overarching goal of cost efficiency, without compromising performance on production, integrity, or health, safety and the environment.

Instilling disciplined management of change. The rigorous management of change, not only at the initiative level but also across programs, is essential to managing interdependencies and ensuring coherent progress.

Follow leading indicators to guide transformation. Part of management’s role is to continuously monitor and adjust the transformation process using leading indicators that track progress and effectiveness, ensuring that the journey toward cost reduction is measurable and controlled.

A path forward for Indonesia

While Indonesia’s upstream energy sector faces mounting cost and performance pressures, it also has a unique opportunity to redefine its future. By embracing innovative asset management approaches, integrating advanced technologies and fostering specialized partnerships, operators can enhance their production and cost performance. These steps are critical to enhancing energy security and ensuring Indonesia’s upstream oil and gas sector remains resilient in a rapidly evolving landscape.

***

Uday Vir Singh is partner, while Marko Lackovic is managing director and partner at Boston Consulting Group (BCG). With special thanks to Aman Modi, Southeast Asia lead for energy, managing director and partner, as well as Steven Ho, a lead knowledge analyst, at BCG.