Q4 2022 Data Shows the Slowest Fourth Quarter Digital Media Revenue Growth in Five Years, According to OAREX

The H2 2022 OAREX Digital Media Revenue Report data details an industry-wide slowdown impacting companies of all sizes

The report evaluated publicly-traded data for companies that primarily earn revenues from digital media operations and were underwritten by the OAREX credit team. To ensure the data reflects true sector performance and is not outweighed by industry giants, the report does not include some of the larger AdTech companies, such as Google, Meta, and Snap, in the more expansive analysis.

The Q4 2022 analyzed data uncovered the following insights:

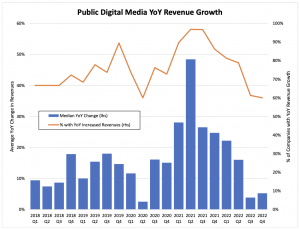

- Digital media revenue growth experienced a median growth of only 5 percent. With a median growth of only 5%, making Q4 2022 the third worst growth in the past 5 years.

- “Big AdTech” performed worse than the rest. Google, Meta, and Snap also saw revenues dip, roughly in line with the companies reviewed.

- Outside of “Big AdTech,” bigger was better. The data suggest that size and performance are correlated, with the YoY growth of larger companies (excluding Google, Meta, and Snap) outperforming the smaller ones.

- But it’s not all grim, with some big winners performing well. While MediaAlpha saw a 23% YoY drop and Viant was down by 34%, others such as Unity, Perion, Zeta Global, Innovid, Hubspot, and DoubleVerify experienced YoY growth rates of over 25%.

In addition, only 60% of the companies analyzed saw increased revenues–much worse than ex-Covid history– which is tied with Q2 2020 for the worst performance in the past 5 years. Also, many large digital advertising-related companies experienced challenging results. Specifically, in Q4 2022, Meta saw YoY revenues decline by 4%, Google Networks (e.g., only the digital display business line at Google) decreased by 9%, and Snap remained unchanged.

Standard deviation is a measure of the volatility of the results. Q4 2022 standard deviation of YoY results was only 19%, one of the lowest in this data set and well below the 30-40% results in 2020 and 2021. With Q4 maintaining low growth levels from Q3, which are substantially below 2018 and 2019 growth levels, it is certain that the slowdown trend is continuing.

“As revenues remain suppressed with each passing quarter, the odds of a profit recession continue to increase,” commented OAREX EVP, Nick Carrabbia. “Combine these factors with recent credit events, and we are reminded that the economic landscape before us remains extremely volatile. However, with risk comes opportunity. Companies confident in their partnerships and financing will be well positioned to capitalize when conditions improve.”

This report was released as part of OAREX’s quarterly digital media revenue analysis series. OAREX also recently recognized a list of 16 Top Payors in AdTech and released the OAREX H2 2022 Digital Media and Advertising Payments Report. Second-quarter revenue data, H1 2023 payments, and Top Payors will be published in reports to be released in mid-2023.

About OAREX Capital Markets, Inc.

OAREX, the Online Ad Revenue Exchange, operates a digital revenue exchange where digital media businesses can exchange future revenue payouts for capital now. Established in 2013, OAREX has become a worldwide leader in financing for digital media businesses. East West Bank’s investment in OAREX is a testament to its model and the digital media industry as a whole. Visit oarex.com for more information or visit go.oarex.com to open an account.

Jen Crompton

WIT Strategy

+1 609-870-0795

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Social Media, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release