Business Travel Accident Insurance Market Forecasted to Expand with 22.2% CAGR Growth, Extending to 2032

Business Travel Accident Insurance Market

Business Travel Accident Insurance Market Forecasted to Expand with 22.2% CAGR Growth, Extending to 2032

NEW CASTLE, DELAWARE, UNITED STATES, April 18, 2024 /EINPresswire.com/ -- Business travel accident (BTA) insurance provides financial protection for businesses, employees, and their families in the event of an accident during a business trip. This includes accidents that occur while traveling to and from work-related events, as well as those that happen during short-term or long-term work-related travel. It covers expenses related to medical treatment, lost wages, and death. Furthermore, it provides coverage for travel disruptions caused by an accident, as well as emergency evacuation and repatriation costs.

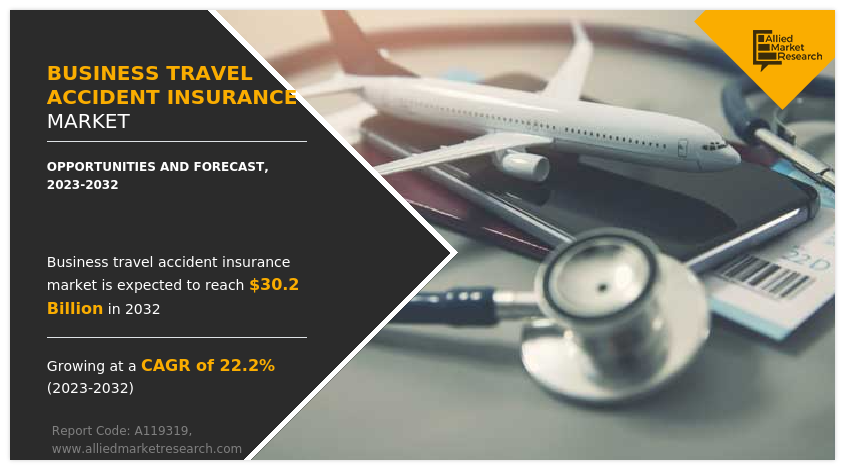

Allied Market Research published a report, titled, "Business Travel Accident Insurance Market by Type (Single-Trip Travel Insurance and Multi-Trip Travel Insurance), Application (Domestic and International), and Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global business travel accident insurance industry generated $4.13 billion in 2022, and is anticipated to generate $30.20 billion by 2032, witnessing a CAGR of 22.2% from 2023 to 2032.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/119803

Prime determinants of growth

The business travel accident insurance market is expected to witness notable growth owing to rise in global business travel. With this rise in travel, there is a greater awareness among businesses about the potential risks employees face while on these trips which drives the adoption of business travel accident insurance policies. Furthermore, an increase in awareness of travel risks, and corporate emphasis on employee well-being further fuels the growth of the market. Moreover, advancement in technology is expected to provide a lucrative opportunity for the growth of the market during the forecast period.

COVID-19 scenario

The COVID-19 pandemic negatively impacted the business travel accident insurance market size. During the pandemic, businesses implemented travel restrictions and employees shifted to remote work, leading to a decline in business travel. This reduced the demand for business travel accident insurance as fewer employees were undertaking work-related trips.

Companies reassessed their travel policies, and some chose to reduce insurance coverage due to the decreased travel activities, contributing to a contraction in the market.

The multi-trip travel insurance segment to maintain its leadership status throughout the forecast period

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://bit.ly/40PED8K

By type, the multi-trip travel insurance segment held the highest market share in 2022, accounting for around three-fifths of the global business travel accident insurance market revenue, and is projected to manifest the highest CAGR of 23.6% from 2023 to 2032. This is attributed to the increasing number of professionals engaging in frequent business travel. Businesses are recognizing the efficiency and cost-effectiveness of providing comprehensive coverage for multiple trips under a single policy, streamlining administrative processes. The convenience and time-saving aspect of an annual plan for regular travelers contribute to the rising popularity of multi-trip insurance.

The domestic segment to maintain its leadership status throughout the forecast period

By application, the domestic segment held the highest market share in 2022, accounting for more than two-thirds of the global business travel accident insurance market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the increasing trend of professionals traveling within their own country for work which has created a higher demand for insurance coverage tailored to domestic business trips. However, the international segment is projected to manifest the highest CAGR of 25.2% from 2023 to 2032, owing to the increasing globalization of businesses. As more companies expand their operations globally, employees frequently embark on international trips for work. The complexity and unique challenges of travel abroad, including diverse healthcare systems and potential unforeseen events, emphasize the need for specialized insurance coverage.

The insurance intermediaries segment to maintain its leadership status throughout the forecast period

By distribution channel, the insurance intermediaries segment held the highest market share in 2022, accounting for nearly one-third of the global business travel accident insurance market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the increase in use of digital platforms to sell insurance products among insurance intermediaries. However, the virtual assistants and customer support segment is projected to manifest the highest CAGR of 27.1% from 2023 to 2032, owing to increase in partnership between insurance providers to deliver affordable business travel insurance policies.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/119803

Europe to maintain its dominance by 2032

By region, Europe held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global business travel accident insurance market revenue, and is estimated to maintain its leadership status throughout the forecast period, owing to the increase in globalization of businesses, which has led to a rise in corporate travel, emphasizing the need for comprehensive insurance coverage. Furthermore, the increase in awareness of potential risks, and the emphasis on corporate responsibility drives the growth of the business travel accident insurance market in Europe. However, Asia-Pacific is expected to witness the fastest CAGR of 25.1% from 2023 to 2032. This is attributed to the rapid economic development in the region and heightened awareness of travel-related risks.

Leading Market Players: -

American International Group, Inc.

Arch Capital Group Ltd.

AXA SA

Chubb

MetLife Services and Solutions, LLC

Starr International Company, Inc.

Tata AIG General Insurance Company Limited

The Hartford

VisitorsCoverage Inc.

Zurich American Insurance Company

The report provides a detailed analysis of these key players of the global business travel accident insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/119803

➡️𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Mobile Money Market https://www.alliedmarketresearch.com/mobile-money-market-A123587

Contactless Payments Market https://www.alliedmarketresearch.com/contactless-payments-market

E-passport Market https://www.alliedmarketresearch.com/e-passport-market

Insurance Advertising Market https://www.alliedmarketresearch.com/insurance-advertising-market-A205140

U.S. Insurance Brokerage for Employee Benefits Market https://www.alliedmarketresearch.com/us-insurance-brokerage-for-employee-benefits-market-A278701

Spain Health Insurance Third-Party Administrator Market https://www.alliedmarketresearch.com/spain-health-insurance-third-party-administrator-market-A264461

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://www.quora.com/profile/Pooja-BFSI

https://medium.com/@psaraf568

David Correa

Allied Market Research

+1 5038946022

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.