On-Demand Insurance global market 2024 to reach $9.59 billion by 2028 at rate of 14.9%

The Business Research Company's On-Demand Insurance global market 2024 to reach $9.59 billion by 2028 at rate of 14.9%

LONDON, GREATER LONDON, UNITED KINGDOM, September 9, 2024 /EINPresswire.com/ --

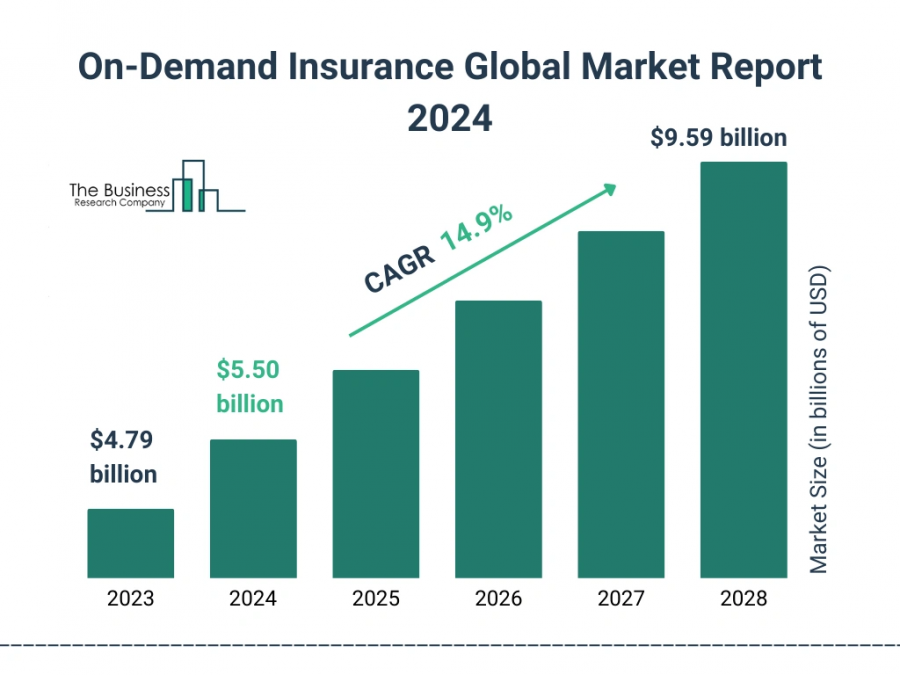

The on-demand insurance market has experienced robust growth in recent years, expanding from $4.79 billion in 2023 to $5.50 billion in 2024 at a compound annual growth rate (CAGR) of 14.8%. The growth in the historic period can be attributed to increased smartphone and internet penetration, consumer demand for convenience, a shift from traditional to digital insurance channels, regulatory changes favoring digital insurance, and increased awareness of digital financial services.

What Is The Estimated Market Size Of The Global On-Demand Insurance Market And Its Annual Growth Rate?

The on-demand insurance market is projected to continue its strong growth, reaching $9.59 billion in 2028 at a compound annual growth rate (CAGR) of 14.9%. The growth in the forecast period can be attributed to increasing use of big data analytics, rising demand for personalized insurance products, proliferation of digital-only insurance providers, increased investment in insurtech startups, and growing popularity of peer-to-peer insurance models.

Explore Comprehensive Insights Into The Global On-Demand Insurance Market With A Detailed Sample Report:

https://www.thebusinessresearchcompany.com/sample_request?id=17213&type=smp

Growth Driver Of The On-Demand Insurance Market

The growing adoption of digital platforms is expected to propel the growth of the on-demand insurance market going forward. Digital platforms refer to online systems that facilitate various services, including the purchasing, management, and customization of insurance policies. Rising adoption is a result of increasing consumer demand for convenience, economic growth, technological advancements, and attractive pricing options. Digital platforms contribute to the rise in on-demand insurance by simplifying the purchasing process, offering competitive pricing, and providing consumers with more confidence in their insurance decisions.

Make Your Report Purchase Here And Explore The Whole Industry's Data As Well:

https://www.thebusinessresearchcompany.com/report/on-demand-insurance-global-market-report

Who Are The Key Players Shaping The On-Demand Insurance Market Trends?

Key players in the on-demand insurance market include Life Insurance Corporation of India, Tata Consultancy Services Limited, Infosys Limited, DXC Technology, Pegasystems Inc.

What Are The Dominant Trends In On-Demand Insurance Market Growth?

Major companies in the on-demand insurance market are focusing on developing innovative products, such as mobile telematics-based comprehensive motor insurance, to offer more personalized and flexible coverage options and to leverage real-time driving data to assess risk accurately, provide usage-based premiums, and enhance customer engagement. Mobile telematics is an app-based solution that creates safer drivers, transforms insurance, fleet management, and more.

How Is The Global On-Demand Insurance Market Segmented?

1) By Coverage: Car Insurance, Home Appliances Insurance, Entertainment Insurance, Contractor Insurance, Electronic Equipment Insurance, Other Coverages

2) By Insurance: General Insurance, Life Insurance, Cybersecurity Insurance, Other Insurances

3) By End-User: Individuals, Business

Geographical Insights: North America Leading The On-Demand Insurance Market

North America was the largest region in the on-demand insurance market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the on-demand insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

On-Demand Insurance Market Definition

On-demand insurance is a flexible insurance model that allows consumers to purchase coverage instantly and for specific periods or events through digital platforms. This insurance is used to provide tailored, short-term coverage for various needs, offering convenience and cost efficiency to users.

On-Demand Insurance Global Market Report 2024 from TBRC covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global on-demand insurance market report covering trends, opportunities, strategies, and more

The On-Demand Insurance Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on on-demand insurance market size, on-demand insurance market drivers and trends, on-demand insurance market major players, on-demand insurance competitors' revenues, on-demand insurance market positioning, and on-demand insurance market growth across geographies. The on-demand insurance market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Insurance Brokers & Agents Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/insurance-brokers-and-agents-global-market-report

Insurance Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/insurance-global-market-report

Insurance (Providers, Brokers and Re-Insurers) Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/insurance-providers-brokers-and-re-insurers-global-market-report

What Does The Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor

Package, and much more.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Companies, International Organizations, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release