Banking as a Service Market Grows with API Integration, Fintech Collaboration, and Rising Demand for Embedded Banking

The Banking as a Service Market is driven by fintech innovations, API-driven platforms, and the demand for seamless financial integrations.

AUSTIN, TX, UNITED STATES, November 27, 2024 /EINPresswire.com/ -- Market Scope and Overview

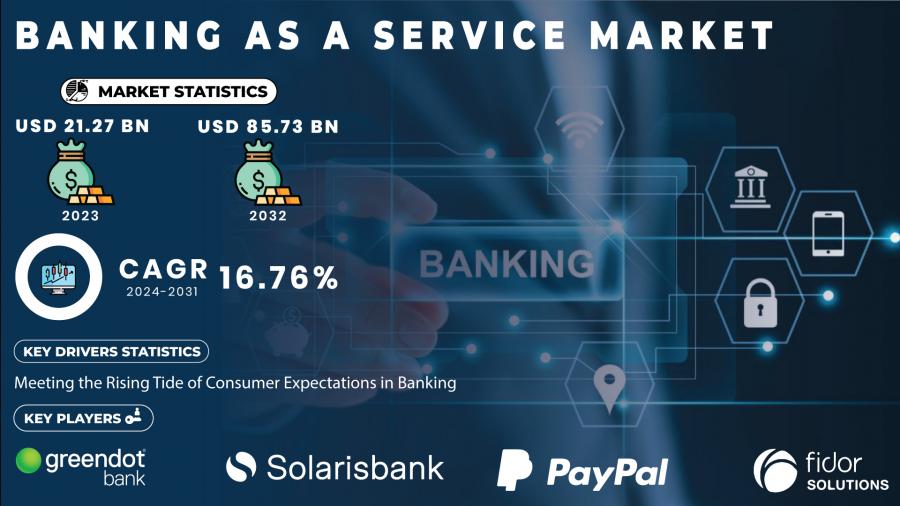

The Banking as a Service Market is experiencing exponential growth, driven by the increasing adoption of embedded finance, partnerships between banks and fintech companies, and the growing demand for seamless, cloud-based digital banking solutions. The market is projected to grow from USD 21.27 billion in 2023 to USD 85.73 billion by 2032, at a robust CAGR of 16.76% during the forecast period of 2024–2032.

Key Trends Driving the Banking as a Service Market

The BaaS market is gaining significant traction due to the growing focus on digital transformation in banking. Traditional banking services are rapidly transitioning to online and mobile-first ecosystems. BaaS platforms enable financial institutions and non-banking entities to offer banking functionalities—such as payments, loans, and account management—directly within their ecosystems.

Government initiatives supporting digital banking further accelerate the market. A report by the U.S. Federal Reserve noted a 36% increase in digital banking adoption from 2019 to 2023, spurred by regulatory frameworks favoring fintech innovation. In Europe, the PSD2 (Revised Payment Services Directive) has been instrumental in driving open banking, fostering an environment where BaaS platforms thrive.

Additionally, the global cloud computing market, a critical enabler of BaaS, has seen remarkable growth. Gartner reported spending on public cloud services reaching USD 597 billion in 2023, supporting the dominance of cloud-based BaaS solutions, which accounted for 69% of the market share that year. These solutions are valued for their scalability, cost-effectiveness, and ability to integrate with third-party APIs.

Get a Report Sample of Banking as a Service Market @ https://www.snsinsider.com/sample-request/3302

Some of the Key Players Studied in this Report are:

➤ Green Dot Bank (Prepaid Cards, Mobile Banking, and Financial Technology Solutions)

➤ Solarisbank AG (API-driven BaaS Platform, Digital Banking Infrastructure)

➤ PayPal Holdings, Inc. (Digital Payments, Peer-to-Peer Payments, BaaS Solutions)

➤ Fidor Solutions AG (Open API Banking, Digital Banking Platform)

➤ Moven Enterprise (Financial Wellness Tools, Digital Banking Solutions)

➤ The Currency Cloud Ltd. (Cross-Border Payments, Multi-Currency Accounts)

➤ Treezor (White-Label BaaS Platform, Payment Processing)

➤ Match Move Pay Pte Ltd. (Digital Wallets, Prepaid Cards, BaaS Solutions)

➤ Block, Inc. (formerly Square, Inc.) (Digital Payments, Financial Services Infrastructure)

➤ Bnkbl Ltd. (formerly Bankable) (White-Label Banking Solutions, Payment Systems)

➤ ClearBank (Cloud-Based Clearing Bank, API Banking)

➤ Railsr (formerly Railsbank) (Embedded Finance Platform, Open Banking)

➤ Marqeta, Inc. (Card Issuing, Payment Processing, BaaS Solutions)

➤ Tink AB (Open Banking Platform, Account Aggregation)

➤ Finastra (Financial Software, Open Banking Solutions)

➤ Temenos (Core Banking Software, Digital Banking Solutions)

➤ Plaid (API Connectivity for Financial Services, Open Banking)

➤ Others

Segment Analysis

By Product Type

➤ Cloud-Based BaaS Solutions: Cloud-based BaaS solutions led the market with 69% market share in 2023, enabling rapid deployment of digital banking services without heavy IT infrastructure investments. Small banks and startups increasingly adopt these solutions to enhance service offerings. For example, a study by the National Bankers Association revealed that 45% of small U.S. financial institutions partnered with BaaS providers in 2023 to launch digital-first banking services.

By Component

➤ Platform Segment: The platform segment dominated the market with a 74% market share in 2023. BaaS platforms provide APIs, tools, and frameworks that seamlessly integrate banking services into partner ecosystems.

➤ Service Segment: The service segment is also witnessing significant growth, with consulting and implementation services in high demand as financial institutions transition from legacy systems to digital-first models.

Market Segmentation and Sub-Segmentation Included Are:

By Product Type

➤ API

➤ Cloud-based BaaS

By Component

➤ Platform

➤ Services

By Enterprise Size

➤ Large

➤ SME

By End-User

➤ Banks

➤ FinTech Corporation

➤ NBFC

➤ Others

Regional Insights

North America held over 41% of the market share in 2023, driven by advanced fintech ecosystems and government support for open banking. Partnerships between banks and fintech companies play a crucial role. For instance, JP Morgan reported a 12% increase in digital customer engagement in 2023 due to its BaaS initiatives. Additionally, Canada allocated CAD 2 billion in 2023 under its Digital Transformation Strategy to boost digital banking innovations.

Europe is a key market, driven by regulatory frameworks like PSD2 and a focus on fintech collaboration. Countries such as the U.K., Germany, and the Netherlands are adopting embedded banking solutions extensively. Eurostat reported that 45% of EU businesses integrated digital payment services in 2023. The Horizon Europe program allocated €1.5 billion to foster open banking standards and digital financial services.

The Asia-Pacific region is projected to register the fastest growth between 2024 and 2032. Countries like China, India, and Singapore lead this surge, driven by high digital engagement and government-backed initiatives. India saw 450 million UPI transactions daily in 2023, while the government launched the National Digital Financial Infrastructure initiative to expand digital banking to rural areas. Similarly, China's fintech boom, led by firms like Ant Group, is driving embedded finance adoption.

Recent Developments

➤ January 2024: Stripe launched a BaaS platform enabling e-commerce businesses to offer embedded banking solutions such as loans and real-time payouts.

➤ March 2023: Finastra partnered with Visa to enhance its BaaS platform with real-time payment solutions tailored for SMEs.

➤ 2023: Solaris raised €200 million to expand its cloud-based BaaS services, focusing on embedded finance for non-banking entities.

Enquire for More Details @ https://www.snsinsider.com/enquiry/3302

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter’s 5 Forces Model

7. PEST Analysis

8. Banking As a Service Market Segmentation, by Product Type

8.1. API

8.2. Cloud-Based BaaS

9. Banking As a Service Market Segmentation, by Component

9.1. Platform

9.2. Services

10. Banking As a Service Market Segmentation, by Enterprise Size

10.1. Large

10.2. SME

11. Banking As a Service Market Segmentation, by End-User

11.1. Banks

11.2. FinTech Corporation

11.3. NBFC

11.4. Others

12. Regional Analysis

12.1. Introduction

12.2. North America

12.3. Europe

12.4. Asia-Pacific

12.5. The Middle East & Africa

12.6. Latin America

13. Company Profile

14. Competitive Landscape

14.1. Competitive Benchmarking

14.2. Market Share Analysis

14.3. Recent Developments

15. USE Cases and Best Practices

16. Conclusion

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: IT Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release