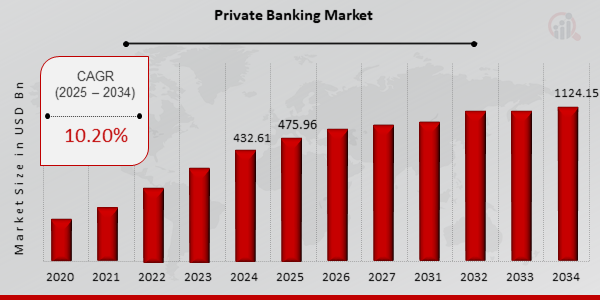

Private Banking Market Grows at 10.20% CAGR, Targeting $1124.15 Billion by 2034

Private Banking Market Growth

Private Banking Market Research Report By, Investment Style, Account Type, Client Segment, Service Offering, Regional

RI, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global Private Banking Market has experienced steady growth and is projected to expand significantly in the coming decade. In 2024, the market size was valued at USD 432.61 billion and is expected to grow from USD 475.96 billion in 2025 to an impressive USD 1,124.15 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 10.20% during the forecast period (2025–2034). This growth is driven by the increasing number of high-net-worth individuals (HNWIs), rising demand for personalized financial services, and advancements in digital wealth management technologies.

Key Drivers Of Market Growth

Increasing High-Net-Worth Individuals (HNWIs): The growing number of HNWIs worldwide, particularly in emerging economies, is a major driver for the private banking market. These individuals demand tailored financial solutions, creating opportunities for private banks to expand their services.

Rising Demand for Personalized Financial Services: Clients increasingly seek personalized wealth management strategies, estate planning, tax advisory, and investment solutions. Private banks are focusing on offering bespoke services to meet these unique financial needs.

Digital Transformation in Wealth Management: The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and robo-advisory platforms has enhanced customer experience and operational efficiency in private banking, driving market growth.

Growing Focus on Sustainable Investments: With a shift toward socially responsible investing, private banks are offering more sustainable and impact-driven investment options to meet the changing preferences of their clients.

Download Sample Pages: https://www.marketresearchfuture.com/sample_request/23978

Key Companies In The Private Banking Market

• Julius Baer

• Pictet Wealth Management

• UBP

• Morgan Stanley Private Wealth Management

• Bank of America Private Bank

• Citi Private Bank

• Rothschild Co

• Wells Fargo Private Bank

• HSBC Private Banking

• Credit Suisse

• JP Morgan Private Bank

• Deutsche Bank Wealth Management

• UBS

• BNP Paribas Wealth Management

• Goldman Sachs Private Wealth Management

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/private-banking-market-23978

Private Banking Market Segmentation

To provide a detailed analysis, the Private Banking Market is segmented based on service type, client type, and region.

1. By Service Type

• Wealth Management: Comprehensive strategies for asset growth and preservation.

• Tax Planning: Tailored solutions to optimize tax efficiency.

• Estate Planning: Services for wealth transfer and legacy planning.

• Investment Management: Portfolio diversification and investment advisory.

2. By Client Type

• High-Net-Worth Individuals (HNWIs): Primary clientele with assets exceeding $1 million.

• Ultra-High-Net-Worth Individuals (UHNWIs): Clients with assets exceeding $30 million.

• Family Offices: Managing wealth and financial affairs for affluent families.

3. By Region

• North America: Leading market driven by the large number of HNWIs and established financial institutions.

• Europe: Growth supported by a focus on sustainable investments and personalized banking solutions.

• Asia-Pacific: Fastest-growing region due to the rising wealth of HNWIs in countries like China and India.

• Rest of the World (RoW): Moderate growth anticipated in regions like the Middle East, Latin America, and Africa due to increasing wealth creation.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23978

The global Private Banking Market is positioned for strong growth, fueled by the increasing wealth of individuals, a greater emphasis on personalized financial solutions, and the adoption of digital tools. With opportunities expanding across regions and sectors, private banking will continue to play a critical role in wealth management and financial advisory services, shaping the future of global financial ecosystems.

Related Report:

Family Offices Industry Market

Digital Banking Platform Market

About Market Research Future

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release