Massachusetts Businesses Partner with Accounting Outsourcing Service Providers to Navigate Regulatory Challenges

Massachusetts businesses partner with accounting outsourcing service providers to ensure compliance, enhance efficiency, and drive growth.

Unlock growth with real-time financial insights in Massachusetts! Click here

These providers offer expertise in global financial frameworks, including U.S. tax laws, national regulations, and international tax codes. Their specialized knowledge helps companies meet compliance requirements while expanding into new markets, reducing risks associated with regulatory complexities. By leveraging these services, businesses can streamline financial processes, improve accuracy in reporting, and focus on strategic growth without administrative burdens.

“Businesses in Massachusetts are embracing accounting outsourcing service providers to navigate complex financial regulations and drive efficiency. By leveraging expert support, companies can streamline operations, maintain compliance, and focus on sustainable growth in an evolving financial landscape,” said Ajay Mehta, CEO of IBN Technologies.

Accounting outsourcing service providers in Massachusetts go beyond compliance by delivering real-time financial insights that drive smarter decision-making and operational efficiency. This shift from routine bookkeeping to strategic financial management enables businesses to optimize cash flow, control expenses, and improve overall performance. In a competitive market, timely and informed financial decisions are essential. By leveraging outsourced expertise, Massachusetts businesses can enhance agility, adapt to market shifts, and focus on sustainable growth.

“Outsourcing financial operations is no longer just an option, it’s a strategic necessity. Accounting outsourcing service providers in Massachusetts help businesses enhance efficiency, reduce compliance risks, and focus on sustainable growth,” said Ajay Mehta.

As businesses across Massachusetts expand into global markets, the complexity of financial regulations continues to grow. Companies are increasingly seeking expert support to navigate evolving tax codes, international compliance requirements, and cross-border financial operations. By leveraging specialized financial expertise, businesses can streamline their accounting functions while ensuring accuracy and regulatory adherence.

Solve bookkeeping challenges—book your free 30-minute session now!

https://www.ibntech.com/free-consultation/?pr=EIN

Outsourcing financial operations also reduces the risk of costly errors and enhances efficiency. Many service providers offer around-the-clock support, allowing businesses to maintain seamless financial processes without disruptions. This continuous access to financial management helps companies stay on track with reporting deadlines and compliance obligations, minimizing potential financial risks.

The increasing need for real-time financial reporting is driving more businesses to seek external accounting solutions. With dedicated teams working beyond traditional business hours, companies can receive timely and precise financial insights, a critical advantage during month-end or year-end closings. Access to accurate data enables faster decision-making, helping businesses remain agile in competitive markets.

One of the key benefits of outsourcing is its ability to adapt to the unique needs of each business. From payroll management to tax planning and financial reporting, accounting outsourcing service providers in Massachusetts offer customized solutions that in-house teams often struggle to match. Businesses facing payroll challenges, such as compliance with wage laws, tax withholdings, and timely salary disbursements can benefit from expert outsourcing services that ensure accuracy and efficiency. This flexibility makes outsourcing an essential strategy for companies looking to optimize financial performance and maintain a competitive edge.

The growing demand for faster financial reporting is driving businesses in Massachusetts to seek efficient accounting solutions. By utilizing dedicated teams that operate beyond standard business hours, companies can access timely and precise financial reports, a crucial advantage during high-pressure periods like month-end or year-end closings. Quick and accurate reporting enables businesses to make informed financial decisions, improving overall operational efficiency in an increasingly competitive market.

To meet evolving industry needs, firms are now offering specialized financial services customized to specific sectors such as healthcare, real estate, and technology. This industry-focused approach ensures businesses receive expert financial management solutions designed to address sector-specific challenges. Accounting outsourcing service providers in Massachusetts play a critical role in helping companies maintain compliance, streamline operations, and enhance financial performance by delivering customized accounting services that align with unique business requirements.

Custom pricing for your business—get a free quote today!

https://www.ibntech.com/pricing/?pr=EIN

As tax laws and financial regulations continue to evolve, businesses in Massachusetts are turning to accounting outsourcing service providers to ensure compliance and streamline financial operations. Offshore expertise allows companies to stay updated on regulatory changes while reducing administrative burdens, enabling them to focus on core business functions and long-term strategy.

IBN Technologies supports accounting outsourcing service providers in Massachusetts by offering customized financial management solutions designed to enhance compliance and operational efficiency. By outsourcing accounting functions to third-party specialists, businesses can reallocate resources toward innovation, customer acquisition, and market expansion. This approach positions companies for sustained growth in an increasingly complex economic landscape.

Source Link:

https://www.ibntech.com/article/outsourced-finance-and-accounting-services-usa/?pr=EIN

Related Services:

1) Catch-up Bookkeeping/ Year End Bookkeeping Services

https://www.ibntech.com/ebook/catch-up-bookkeeping-guide-for-financial-and-tax-success/?pr=EIN

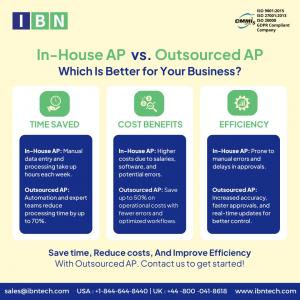

2) AP/AR Management

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EIN

3) Tax Preparation and Support

https://www.ibntech.com/us-uk-tax-preparation-services/?pr=EIN

4) Payroll Processing

https://www.ibntech.com/payroll-processing/?pr=EIN

5) USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release