Global Institutional Investor Survey 2024 Report

Georgeson’s Global Institutional Investor Survey highlights some of the top priorities and strategies of institutional investors around the world.

Priorities for 2025 include executive pay, shareholder rights, climate transition and human capital management.

Such priorities can provide indicators for companies seeking to address potential risks and opportunities in a dynamic market environment increasingly shaped by active ownership.

Regulatory and policy changes in the US, as well as evolving political and cultural shifts, have injected new complexities into many areas of environmental, social and governance (ESG) discussions.

New public policy developments, such as the SEC’s staff legal bulletin (SLB) on 14M and the recent change to 13D-G reporting, are some of the structural changes affecting how issuers and investors engage.

One notable impact of the SEC’s SBL 14M is that it reverses the significant social policy inclusions found in SLB 14L, which had emphasized consideration of broader societal effects of shareholder proposals. As a result of this change, more issuers will likely seek and receive ‘no action’ relief on some ESG-focused shareholder proposals. As of February 19, 2025, there were already more ‘no action’ requests than during the entire 2024 proxy season.

Schedule 13D requires shareholders, or a group of shareholders, holding a specific portion of shares in a company to disclose their ownership within a significantly shortened timeframe. The recent guidance by the SEC implies that passive investors who typically file 13G may need to file lengthier and more detailed 13D forms when engaging on ESG issues or corporate governance matters if such engagements are intended to influence corporate governance in any way.

These recent changes, along with the polarized nature of ESG issues in the US, have notably influenced institutional investors’ strategies and approaches to stewardship. For example, they have revised their proxy voting guidelines and are adapting how they engage with issuers ahead of meetings.

Some companies and investors have further decreased their public disclosure on social and diversity-focused topics, particularly in regions with pronounced political opposition to ESG principles. These rapid and dynamic shifts in the US market are an important consideration when reviewing the results of the global investor survey.

Look ahead

We expect that climate-related financial risks to continue to command investors’ attention owing to the tangible and measurable nature of global climate targets, which many investors see as having a clear financial and operational impact.

We encourage US-based companies to continue to engage meaningfully with their shareholders and provide voluntary disclosures in order to interpret the expectations of their largest investors.

KEY FINDINGS FROM THE INVESTOR SURVEY

Overall, the survey highlights a shift towards more strategic and impactful investor engagement. Most of our investor respondents are increasingly demanding transparency, accountability, and alignment with long-term value creation. Companies that prioritize these factors and engage proactively with shareholders are likely to build stronger relationships and attract long-term capital.

Engagement and Communication

- Engagement Influence: Investors prioritize meaningful dialogue, clear communication, and strategic planning in engagement. 85% of respondents reported that engagement significantly influences their voting decisions.

- Off-season Engagement: Proactive communication outside of proxy season builds trust and facilitates deeper discussions. 62% of respondents prefer addressing complex or contentious issues during off-season periods.

- Board Access: Investors are increasingly seeking direct access to board members to discuss governance concerns and strategic direction. 52% of respondents indicated a growing demand for direct interaction with board members.

Strategic Activism and Shareholder Influence

- Substantive Activism: Investors favor activist campaigns that are well-researched, financially sound, and aligned with long-term value creation. 87% of respondents highlighted financial performance and a compelling strategy as critical factors for supporting specific activist campaigns.

- Openness to Dialogue: Investors are increasingly open to engaging with activists who present compelling proposals and demonstrate a credible track record. 85% of respondents indicated they are willing to engage directly with activists to discuss and evaluate proposals.

ESG Engagement Priorities

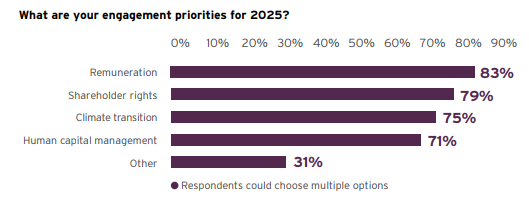

- Four Key Focus Areas: The key focus for investors in 2025 are remuneration, shareholder rights, climate transition, and human capital management. 83% of respondents highlighted remuneration as a key priority, followed by shareholder rights (79%), climate transition (75%), and human capital management (71%).

- ESG Materiality: Investors are focusing on ESG issues that have clear financial implications, such as climate risk, human capital, and cybersecurity. 77% of respondents are prioritizing ESG issues with clear financial relevance.

- Regulatory Compliance: Regulatory pressure is intensifying the focus on ESG, prompting most investors to align their strategies with evolving standards. 85% of respondents expect regulation to be the primary force driving ESG engagement.

Investor Strategies and Tactics

- Targeted Engagement: Investors are becoming more selective about how they engage, concentrating on those companies where they can have the greatest impact. 65% of respondents will focus on companies where they see the potential for meaningful influence.

- Stronger Stance: Some investors are ready to take more assertive actions, such as voting against management and divestment, if companies fail to address concerns. 33% of respondents are prepared to vote against management proposals if progress is insufficient.

ABOUT THE INVESTOR SURVEY

Purpose

Georgeson’s Global Institutional Investor Survey offers actionable insight into the ESG priorities, practices, and expectations of institutional investors regarding proxy voting, shareholder engagement, and investment decisions. Its global focus serves as a resource for corporate boards, investor relations teams, and governance professionals, highlighting key investor perspectives and emerging trends. Drawing on insights from institutional investors with extensive global experience, the survey’s findings help companies to refine their strategies and better understand their shareholder sentiment.

Methodology

Georgeson’s Global Institutional Investor Survey is based on insights gathered from in-depth interviews with 127 Investment Stewardship specialists at 52 Institutional Investor firms with voting and engagement expertise across Europe, Middle East and Africa (EMEA), the Americas, and Asia-Pacific (APAC). The participants represent a combined $47 trillion assets under management (AUM). Virtual interviews and in-person meetings were conducted between 15 September and 25 October 2024. The tailored questions were designed to capture both quantitative and qualitative responses on a range of critical themes focused on engagement and voting activities.

Participants included a diverse range of professionals including ESG analysts, Investment Stewardship analysts, Heads of Investment Stewardship, Heads of Corporate Governance, and Corporate Governance analysts. The respondents represent a mix of global investment firms from the US, the UK, France, Netherlands, Belgium, Hong Kong, Singapore, and Australia.

Breakdown of Geographic Locations of Respondents

Investor Demographics

The survey sample includes 85% asset managers and 15% asset owners, reflecting a strong representation of investment management professionals with direct oversight of voting and engagement activities on behalf of large portfolios.

- All investor respondents dedicated more than 80% of their assets under management to equity investments, underscoring the pivotal role that public market investments play in shaping proxy voting outcomes, driving shareholder engagement, and integrating ESG factors into informed investment decision-making.

SURVEY RESULTS

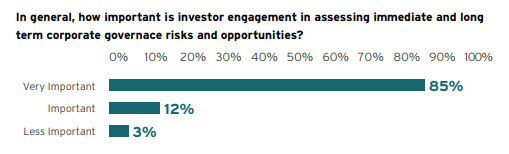

In General, How Important Is Investor Engagement in Assessing Immediate and Long-term Corporate Governance Risks and Opportunities?

The survey results underscore the central role investor engagement plays in governance assessments.

- An overwhelming 85% of respondents reported that engagement with companies significantly influenced their voting decisions.

- 12% indicated that engagement had some influence, suggesting that, for these respondents, engagement provided a complementary role alongside rigorous analysis of governance frameworks and material performance metrics.

- Only 3% of respondents said investor engagement had ‘minimal influence’. These investors said that they often took a more quantitative-driven approach, prioritizing market conditions over direct interaction.

What Are Investors Saying?

“Engagement is key to effective voting. We focus on governance issues, from skill gaps in leadership to shareholder returns, and we push for better transparency and accountability, particularly when we notice trends in underperformance.”

— US-based investor

“If a company continues to show a lack of responsiveness after multiple engagements, escalation is necessary. This can include voting against resolutions or even divesting from the company if governance issues remain unaddressed.”

— EMEA-focused Stewardship Analyst

Unlocking Corporate Resilience: The Power of Shareholder Engagement

The survey’s dominant finding that engagement largely influenced voting decisions clearly reinforces the value of dialogue between investors and companies. Shareholder engagement drives informed capital allocation and ensures that governance practices address material risks and opportunities critical to companies’ long-term success.

By fostering open communication with investors, companies promote transparency in corporate strategy, risk management, and ethical practices. This proactive approach helps to identify material governance risks before they escalate into financial or reputational liabilities.

Active engagement is often viewed as a driver of long-term value creation rather than short-term gain. By promoting responsible governance, sustainable business practices, and effective capital allocation aligned with material risks and opportunities, institutional investors help position companies for lasting success. This alignment of corporate strategy with both financial and non-financial investor priorities strengthens company resilience and trust in the marketplace.

Many institutional investors are also urging companies to adopt more ambitious environmental and social (E&S) initiatives including climate strategies, diversity and inclusion efforts, as well as improved labor practices. These shifts reflect societal and regulatory expectations and a growing understanding among investors, companies, and their boards that sustainable practices can directly impact long-term performance and capital allocation.

Key Trends

- Enhanced data analytics and real-time tracking of shareholder engagement outcomes empower investors to integrate materiality assessments into their decision-making.

- Public stewardship disclosures drive greater accountability, pressuring companies to demonstrate how engagement informs their capital allocation and strategic priorities.

- Sustainability considerations are now routinely embedded into voting and investment decisions, reflecting evolving regulations and client demands for responsible outcomes.

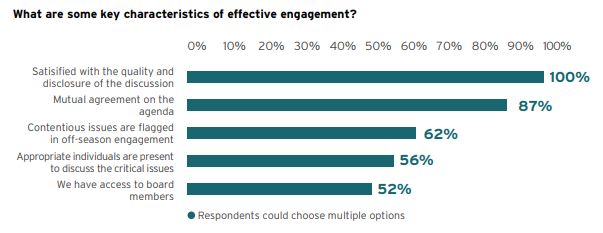

What Are Some Key Characteristics of Effective Engagement?

Institutional investors provided valuable insights into refining engagement strategies to drive accountability and positive change within companies.

- Quality of Responses: Investors unanimously highlighted the importance of clear and insightful answers during engagements. Transparent and meaningful dialogue is essential for addressing concerns and ensuring productive discussions.

- Mutual Agreement on Agenda: A significant 87% of respondents stressed the importance of agreeing on agenda items before a meeting. When both parties agree on priorities, it fosters collaboration and increases the likelihood of achieving actionable outcomes.

- Timing of Engagement: Nearly two-thirds (62%) of respondents prefer to address complex or contentious issues during the off-season period. This strategic timing facilitates deeper, less pressured conversations on sensitive topics.

- Involvement of Key Individuals: Engaging with the right individuals—such as senior leaders, board members, or sustainability officers—was a recurring theme amongst investors, with 56% of survey respondents citing their preference for speaking to appropriate individuals during their discussions with companies. Investors value company executives, directors, or other subject matter experts who are knowledgeable and confident in addressing specific topics, rather than those lacking expertise or context.

- Access to the Board: Around 52% of respondents indicated a growing demand for direct interaction with board members. Such access is pivotal for discussing governance concerns and establishing a direct line of communication with decision-makers.

What Are Investors Saying?

“If we engage in consultation, we expect transparency. Late materials or lack of preparation signals poor governance. Constructive dialogue requires both sides to come to the table with clear agendas and a willingness to listen.”

— US-based investor

“While some companies seem to only engage reactively after proxy recommendations, we prefer proactive engagements where both sides can explore opportunities and concerns early, allowing enough time to make meaningful progress before a vote.”

— EMEA Stewardship Analyst

“We stress the importance of proactive company engagement. Those seeking input shortly before AGMs are often lobbying rather than genuinely listening, which may lead us to decline such dialogues.”

— European-based Investor

Defining good engagement: Insights from institutional investors

Many of the investor respondents said that they often regard most dialogues with companies as reasonably successful, but also said that there is often room for improvement. Shareholder engagement continues to be a priority amongst most companies. Recognizing what constitutes “good engagement” can help companies evaluate shareholder interactions, align with investor priorities and achieve meaningful outcomes.

Engagement fatigue has led many investors to adopt a “quality over quantity” approach to shareholder dialogue. Successful engagements rely on quality communication, strategic planning and the presence of knowledgeable representatives. Companies that prioritize these factors can foster stronger relationships with investors, facilitating meaningful discussions that benefit both parties.

What Are Investors Saying? (Continued)

“Engagement is not just about meeting numbers or sharing documents. It’s about ensuring meaningful discussions that align with our investment strategy, with a focus on financial materiality and long-term value creation.”

— UK-based investor

“If a company fails to address key concerns during engagement, especially around contentious issues, it risks receiving significant dissent on the vote. Engagement should lead to actionable outcomes, not just be a formality.”

— US-based investor

“It’s frustrating when companies are slow to respond to engagement. When we see issues but no action, we are prepared to vote against, as continuing silence or inaction is no longer acceptable. The market needs to know we expect change.”

— US-based investor

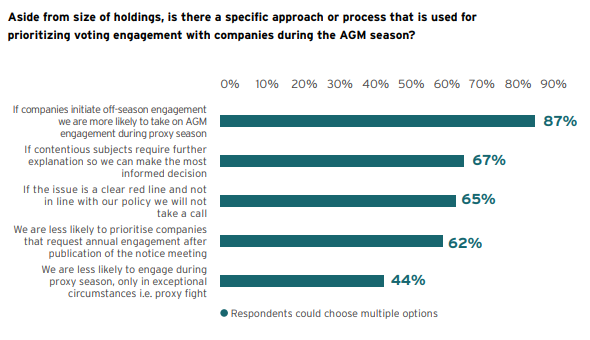

Aside from the Size of Holdings, Is There a Specific Approach or Process for Prioritizing Voting Engagement with Companies During the AGM Season?

The AGM season is a critical period for companies to engage with investors on governance matters and specific, contentious issues, such as climate action, executive pay, and diversity. We spoke to investors to gain insight into their engagement preferences and how they decide which companies to prioritize throughout the year.

- Preference for Off-season Engagement (87%): Proactive off-season communication builds trust and reduces the possibility of a contentious proxy outcome. Companies that engage early demonstrate a commitment to long-term relationships. Many investors continue to focus on governance issues that have significant potential impact on financial performance and sustainability. For instance, markets facing environmental risks may see greater emphasis on climate-related resolutions, whilst tech-focused markets might prioritize data privacy, artificial intelligence, and equity concerns. Many asset managers prioritize companies aligned with their company’s stewardship, investment philosophy, and ESG mandates. For example, asset managers with climate agendas often target high-emission companies, while others prioritize diversity initiatives.

- Clarity on Contentious Issues (67%): Engaging with investors early to explain contentious decisions can reduce shareholder opposition before AGMs. Investors are more likely to prioritize meetings with companies that respond to feedback. Companies that resolve issues efficiently and demonstrate a willingness to communicate are more likely to earn or maintain investors’ support.

- Policy Conflicts (65%): Investors are unlikely to engage on agenda items that contradict their voting policies, underscoring the need for companies to align with shareholder expectations. Firms with poor governance practices, such as excessive executive pay or inadequate board independence, often draw increased scrutiny.

- Timeliness of Requests (62%): Late engagement requests, such as for post-notice outreach, are deprioritized as they appear less genuine.

- Proxy Season Engagement (44%): A significant portion of the investors (44%) said that they are less likely to engage during the hectic proxy season.

As the survey responses demonstrate, institutional investors should prioritize proactive, transparent and timely engagement, especially outside the AGM season. Companies can adopt long-term strategies, focus on early dialogue and align with investor policies when appropriate. This approach will help improve shareholder engagement and voting outcomes, reinforce trust and demonstrate robust governance practices.

What are investors saying?

“If a company ignores our feedback or disregards our suggestions, it’s disappointing. When they provide no compelling explanation for their decisions after engagement, it erodes trust and can lead to a vote against.”

— EMEA Stewardship Analyst

“We don’t just vote against resolutions without understanding the full context. When companies don’t address shareholder concerns or show no progress, we take a more active role, including co-filing or engaging through collaborative actions.”

— US-based investor

Does Your Firm Have Any Key Considerations You Want to Emphasize for Companies That Seek to Initiate Thematic Engagement with Its Top Investors?

Engagement, particularly around themed topics including sustainability and ESG concerns, has become a key focus for companies and institutional investors. This approach extends beyond traditional financial metrics to address broader issues, such as climate impact, social equity, and governance risk – all of which are factors influencing long-term resilience and societal contributions. Despite geopolitical challenges and the rise of anti-ESG sentiments, many investors will continue their well-established engagement strategies and treat such ‘thematic’ engagement efforts as standard practice.

Key Investor Priorities in Thematic Engagement

- Size of Holdings (75%): Investors with larger shareholdings at companies have a vested interest in prompting engagements with the company and its board to influence long-term strategy.

- Financial Materiality (71%): Despite accepting broader ESG metrics, investors still prioritize ESG issues with clear financial implications, such as climate risks in energy or data privacy in tech, highlighting the pressure on companies to integrate sustainability into their core business models.

- Responsiveness (62%): Companies that fail to address investors’ feedback risk escalated actions, such as voting against directors. This shows that companies’ responsiveness to shareholder concerns is not just desirable but critical to avoiding reputational damage and governance challenges.

- Priority Target Lists (60%): Investors increasingly focus on pre-determined lists of sector-specific, high-impact companies, by organizing strategies aimed at driving systemic change within such industries.

- Historical Engagement (46%): Past engagement success shapes future priorities. It is therefore important that companies need to show progress and keep detailed records of outcomes. Businesses that consistently address investor concerns build long-term trust and reduce adversarial actions.

Thematic ESG Engagement

Companies that actively engage shareholders on sustainable related issues can address risks, such as regulatory penalties, supply chain disruptions, and rising costs, while building long-term relationships with shareholders.

Effective ESG engagement fosters two-way dialogue, aligning corporate strategies with stakeholder and regulatory demands. It also helps to ensure board oversight and accountability, especially when addressing critical issues. A committed board can drive meaningful progress and help embed ESG principles into the company’s core operations, reinforcing trust and long-term value creation.

What Are Investors Saying?

“Engagement needs to be proactive and ongoing, especially off-season. We prefer when companies come to us early to discuss issues before the AGM, allowing time to understand proposals and provide feedback, which leads to better-informed decisions.”

— European-based Investor

“The key to effective engagement is bringing the right people to the table. Directors and senior leadership need to be involved, especially on issues like governance and strategy.”

— US-based Investor

SHAREHOLDER ACTIVISM

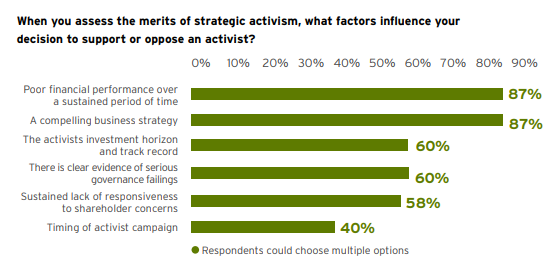

When You Assess the Merits of Strategic Activism, What Factors Influence Your Decision to Support or Oppose an Activist?

During the past fifteen years, shareholder activism has grown from a US-centric phenomenon into a global movement, impacting corporate governance across Europe, Asia, and Latin America. Activists initially focused on unlocking financial value, enhancing operational efficiency, and returning capital to shareholders through buybacks or dividends. They now embrace a broader range of topics, including ESG issues.

Strategic activism continues to drive mergers, acquisitions, and restructuring initiatives to optimize shareholder returns. Simultaneously, ESG campaigns, increasingly championed by NGOs and individual shareholders, emphasize sustainability, diversity, and ethical governance to foster long-term shareholder value. Evolving regulations, transparency standards, and enhanced shareholder rights have further fueled this dual focus, cementing shareholder activism as a transformative force in modern corporate governance.

The rise of ESG-focused activism has redefined corporate governance. Activists, often NGOs, primarily seek responsible investing strategies, leading to changes in board compositions, executive policies, and corporate strategies. Seeking support from institutional investors, this form of activism aims to align investment strategies with global sustainability goals while maintaining an emphasis on financial performance.

- Record-breaking Numbers: The first half of 2024 saw a record-breaking 147 activist campaigns globally, surpassing the previous 143 campaigns which took place during the first half of 2018.

- Diverse Drivers: While financial performance remains a cornerstone, ESG considerations are increasingly prominent.

- Evolving Landscape: The activist arena is diversifying, with new participants employing a broader range of strategies.

Challenges and Opportunities

Despite the rise in activist campaigns, success rates vary. In the US, for instance, activists won only 11% of board seats sought in proxy fights in early 2024. Balancing short-term financial gains with long-term value creation remains an ongoing challenge for both activists and companies. The growing emphasis on ESG factors adds complexity but also presents an opportunity for companies to align activism with sustainable value creation. It is worth noting that behind-the-scenes negotiations, while harder to track and measure, often play a crucial role in unlocking value and driving outcomes that may not obviously reflect public campaign statistics.

Building Trust: Track Records and Responsiveness Drive Activist Support

Global investors are becoming more discerning about evaluating activist campaigns, focusing on substantive factors rather than superficial ones. Key drivers include:

Financial Performance

Poor financial performance remains the top trigger for activism, with 87% of respondents highlighting it as a critical factor for supporting campaigns. Activists gain traction when targeting companies with prolonged underperformance. Investors view this as a direct opportunity to unlock value and steer the company back on track.

Compelling Strategy

Most (87%) of respondents cited a well-articulated and actionable strategy as a key factor in their decision to support activism. Investors gravitate toward campaigns that provide a clear roadmap for sustainable value creation, addressing critical weaknesses while offering a tangible path forward. Such clarity inspires confidence and demonstrates that the activist has a deep understanding of the company and its challenges. As a result, the activist is viewed as a constructive agent of change by other investors.

In the context of ESG activism, there is growing concern about ESG fatigue, as shareholders become increasingly wary of campaigns with overly prescriptive resolutions or those that make broad, generic demands. As such, there is a risk that ESG activists might alienate investors if their proposals seem disconnected from the company’s strategic objectives or appear to be a ‘check-the-box’ solution. While ESG factors are undeniably important, investors look for campaigns that integrate financial materiality in a way that complements long-term value creation, rather than imposing rigid, one-size-fits-all mandates. Activists who can combine strategic, operational improvements with thoughtful ESG integration—without overwhelming shareholders with excessive demands—are more likely to earn support and drive meaningful, sustainable change.

Track Record

Sixty percent of the investor respondents agreed that it is crucial for activists to have a credible track record. Activists with a proven history of delivering sustainable results inspire confidence and are more likely to gain support. Long-only investors assess the reputational risks and the activist’s investment horizon, favoring those with a long-term focus over short-term players. A strong track record signals expertise, reduces concerns over risks, and assures investors that proposed changes are aimed at long-term value creation rather than opportunistic, quick-turnaround strategies.

When it comes to ESG activism, a solid track record is especially critical, as investors seek activists who have demonstrated success in driving responsible governance, improved environmental impact, and enhanced social responsibility. A history of championing ESG principles not only builds credibility but also aligns the activist with the growing trend of responsible investing, which is a significant factor for investors prioritizing sustainability and risk reduction. Activists who have previously delivered on ESG initiatives are more likely to gain trust, as they can demonstrate that their efforts are consistent with long-term value creation and broader societal benefits.

Governance and Responsiveness

Investors are more likely to support activist campaigns when the target company has significant governance failings (60%) or lack of responsiveness (58%), particularly in markets with strong regulatory frameworks, such as in Europe and Japan. Transparency and accountability remain essential, as investors seek to align with activists addressing systemic governance issues. Governance failings often erode shareholder trust, amplifying the case for external intervention.

Timing

Only 40% of investors thought timing was a factor in supporting activist campaigns. Investors, therefore, appear less influenced by the timing of an activist campaign launch compared to the substantive merits of such campaigns.

The survey results highlight a more discerning approach by global investors when evaluating activist campaigns, with a clear emphasis on factors that drive long-term value creation and corporate accountability.

While poor financial performance and a compelling strategy remain critical, it is the activist’s record of accomplishment, governance, and responsiveness that increasingly shape the success or failure of their campaigns. A credible track record is now a key differentiator, with investors gravitating toward activists who demonstrate a history of delivering sustainable, positive change. It is vital that traditional investors see activists as long-term, responsible players rather than opportunistic short-term investors.

What Are Investors Saying?

“While we’re not activist-driven, if the issues raised by an activist align with our long-term goals and concerns, we’re open to supporting them. Ultimately, it’s about improving governance and performance over time.”

— EMEA Stewardship Analyst

“When assessing dissident board nominees, we prioritize strong governance and performance. If an activist’s case is backed by clear evidence of underperformance and necessary change, we may support their proposal to add new board members.”

— Top 10 US-based Investor

Similarly, governance failings and a lack of responsiveness are red flags for investors, particularly in regions with strong regulatory frameworks. Companies that fail to prioritize transparency, accountability, and a constructive relationship with shareholders may find themselves more vulnerable to activist interventions. These findings therefore send a strong message to companies: in today’s environment, traditional investors expect more than just a financial turnaround; they are looking for strategic clarity, solid governance, and a commitment to long-term value creation. Activists who can address these concerns are far more likely to succeed in garnering investor support, while companies that overlook these factors risk undermining shareholder trust and becoming targets for activism.

Ultimately, the survey reveals that investors are placing increasing importance on how well activists engage with governance structures and their ability to demonstrate a track record of responsible, sustained action. This shift signals a broader evolution of activism that is both financially savvy and governance-focused, aligning with the priorities of long-term, traditional investors.

What Are Investors Saying? (Continued)

“In strategic activism, the investment case is key. We need to trust that the proposed changes will benefit long-term value creation. If we’ve already raised these issues ourselves, an activist can amplify the message with greater impact.”

— Top 10 UK-based Investor

“Dissident board nominations require careful consideration. If the activist’s concerns about governance are valid and align with our investment thesis, we’ll weigh their arguments carefully, even if it means challenging existing leadership.”

— EMEA / APAC Stewardship Analyst

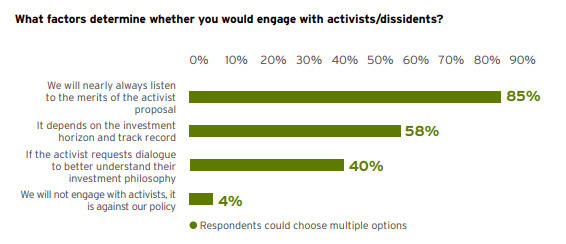

What Factors Determine Whether You Would Engage with Activists/Dissidents?

During the past 10 to 15 years, traditional asset managers have significantly shifted their stance on shareholder activism. Investors were hesitant to align with activists in the past, but they now view strategic engagement with activists as a viable means to influence corporate behaviour and create shareholder value.

Key Trends Driving Alignment Between Traditional Asset Managers with Activists:

- Active Stewardship and Transparency: Asset managers increasingly leverage their voting power to influence governance and strategic decisions. Many now publish detailed voting records, issue statements on key governance matters, and engage in shareholder proposals, signalling a marked departure from their past reticence.

- Focus on ESG and Long-term Value: ESG analysis of investments has enabled managers to better assess risks and opportunities tied to climate, workforce dynamics, and broader systemic challenges. This reinforces their commitment to sustainable value creation and risk mitigation.

- Institutional Client Influence: Pension funds and endowments are vocal advocates of sustainable investing, pressuring managers to align with activist priorities, and further encouraging collaboration with activists on shared objectives.

Evidence of Increased Engagement

Collaborative ESG Initiatives: Institutional investors are increasingly working together to push for change. This collaboration often takes the form of signing joint letters to companies advocating for governance reforms or ESG improvements. Unlike traditional activist campaigns demanding public action, these efforts emphasize collective, private engagement to drive strategic and sustainable outcomes.

Widespread openness to activist proposals (85%): Most respondents indicated they are willing to engage directly with activists based on the merits of their proposals. This reflects a significant shift in attitude, with asset managers recognizing activism as a potential tool for driving value and improving governance.

Track record and investment horizon (58%): More than half of respondents emphasized the importance of an activist’s proven track record and alignment with an investor’s long-term investment objectives when deciding whether to engage. Asset managers value activists who demonstrate credibility through prior successes and a clear, strategic approach to driving sustainable value. This focus ensures that traditional investors can evaluate proposals with confidence, knowing they come from experienced parties with a thoughtful perspective. While maintaining independence in their decisionmaking, asset managers view these engagements as opportunities to gain insights and assess proposals within the context of their own investment objectives.

What Are Investors Saying? (Continued)

“We engage deeply when we spot governance failures that affect long-term value. If an activist makes a compelling case for change, we’ll take it seriously. It’s a rare decision, but it’s made in close collaboration with our portfolio managers.”

— APAC Stewardship Analyst

“We don’t meet with every activist, but when credible ones reach out, we engage. Understanding their strategy and objectives is key. Our role is to assess whether their approach supports sustainable value, rather than opting for quick returns or disruptive changes.”

— US-based investor

Shared Philosophy as a Key Driver (40%): When approached by activists, 40% of respondents indicated a willingness to meet one-on-one to build a relationship and gain a deeper understanding of the activist’s strategy and approach. This reflects a major shift, compared to more than a decade ago. It is now standard practice for asset managers to assess the alignment between their own long-term objectives (such as sustainable growth and corporate governance improvements) and an activist’s philosophy. These one-to-one interactions allow traditional long investors to assess potential synergies and establish trust, creating a foundation for meaningful engagement when goals are aligned.

Rejection of Activism (4%): Only a small minority categorically refuse to engage with activists, illustrating a significant cultural shift from outright rejection to thoughtful consideration of activists as partners in governance.

Implications

The findings illustrate a transformative shift in how traditional asset managers view and engage with activist investors. Once hesitant to interact, these managers now recognize activists as potential sources of strategic insight, provided that their approaches align with long-term investment goals.

Direct engagement has become a norm, with asset managers increasingly open to meeting with activists one-on-one to understand their strategies and evaluate proposals based on their merits. This shift underscores a maturing perspective: some activists are no longer seen as adversaries but as contributors to broader conversations about companies’ governance, strategy, and sustainable value creation. However, asset managers remain independent in their decision-making, using these discussions to inform their own judgments and maintain alignment with their fiduciary responsibilities.

Traditional investors will engage with activists based on key factors such as aligning investment philosophy, the activist’s track record, and their commitment to holding the investment long-term. This selective approach ensures that asset managers remain discerning, supporting initiatives that align with their own priorities while avoiding opportunistic or misaligned campaigns.

The data also reflect a broader trend toward transparency and active stewardship. By thoughtfully engaging with activists, traditional managers enhance their ability to influence corporate behaviour and drive sustainable outcomes, responding effectively to client expectations and regulatory pressures.

In sum, the evolving relationship between traditional asset managers and activists signifies a pragmatic, case-by-case approach to activism, rooted in a commitment to sustainable growth, governance improvement, and long-term value creation.

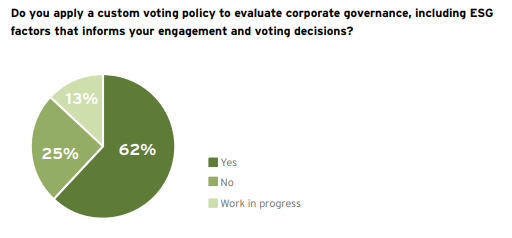

Do You Apply a Custom Voting Policy to Evaluate Corporate Governance, Including ESG Factors That Inform Your Engagement and Voting Decisions?

Custom Voting Policies and ESG Scoring in Shareholder Activism

Asset managers are increasingly applying custom voting policies and proprietary ESG scoring systems (such as JPMorgan Asset Management‘s recent update), reflecting a more sophisticated approach to guiding shareholder engagements and voting decisions. These tools allow managers to target specific governance risks and ESG issues with greater precision, enhancing their influence on corporate behaviour, particularly in relation to shareholder activism. This behind-the-scenes strategy enables more effective engagement, aligning asset managers’ long-term goals with client interests, while also addressing ESG concerns.

Strategic Advantage

Custom voting policies offer asset managers the ability to vote in line with the long-term interests of their clients. Many respondents have said that this type of tailored approach strengthens their role as active stewards of capital but also enables them to remain focused on sustainability and long-term value creation. Proprietary ESG scoring systems add another layer of specificity by using detailed, internal metrics that go beyond generic ratings. These systems allow asset managers to evaluate risks, such as governance failures or environmental threats, that may not be captured in traditional ESG ratings. This, in turn, allows for more informed and targeted voting decisions, enabling asset managers to support or oppose proposals by either management or shareholders with greater confidence.

Challenge and Considerations

There are challenges to implementing custom voting policies and proprietary ESG scores, particularly when it comes to creating cross-market consistency. What constitutes a critical ESG factor in one region may be less relevant in another because of cultural or regulatory differences. Asset managers must balance local relevance against having consistent assessment criteria across the globe, which can be complex, especially when engaging across diverse markets.

Growing Adoption of Custom Voting Policies

The survey results show a significant shift amongst investors toward customized, data-driven engagement strategies. 62% of respondents have implemented such custom voting policies or proprietary ESG scoring systems, indicating that asset managers are increasingly leveraging these tools to guide active ownership and contentious scenarios. This trend reflects a move toward “quiet activism,” whereby influence takes place for strategic reasons behind the scenes, avoiding public-facing campaigns.

- Strategic Escalation: Custom voting and proprietary ESG scores enable asset managers to escalate engagement in a more targeted, private manner, exerting influence without relying on public pressure or traditional activist tactics.

What Are Investors Saying?

“ESG is a material theme for us, but we approach it strategically. We don’t push for broad ESG mandates, rather we focus on specific issues like climate change and deforestation, ensuring our votes align with long-term client interests and financial risks.”

— US-based Investor

“ESG activism presents both opportunities and challenges. While we consider the environmental and social impacts, we also weigh the political dynamics and ensure any action aligns with our broader investment strategy and long-term goals.”

— Top 10 US-based Investor

Sophisticated ESG Evaluation: Nearly two-thirds (62%) of asset management firms have already adopted either a custom ESG voting policy or proprietary scoring system, whilst 13% of firms have indicated that it is underway. This suggests there is a clear move toward more sophisticated, internally driven ESG assessments. Proprietary scoring systems provide tailored insights that go beyond generalized ESG ratings and are particularly useful to address concerns about inconsistencies and a potential lack of detail in traditional methods.

Barriers to Adoption: Despite the growing trend, a quarter (25%) of respondents have not yet implemented these systems, possibly due to resource constraints or a preference among investors for traditional engagement methods. However, with increasing pressure from clients and regulators, these firms may face growing calls to enhance their ESG engagement practices.

Overall, the shift toward custom voting policies and proprietary ESG scoring systems marks a significant evolution in shareholder engagement and approach to active ownership, particularly in relation to ESG. These tools allow asset managers to engage more strategically and privately, supporting ESG reforms in ways that are data-driven and aligned with long-term client interests. This ‘quiet activism’ is particularly valuable in markets where public-facing campaigns may not be as culturally acceptable or where regulations are still evolving, making them an increasingly important tool for modern asset managers.

What Are Investors Saying? (Continued)

“ESG proposals can be a powerful escalation mechanism, but we won’t support them blindly. We need to evaluate the company’s progress and determine if the proposal addresses a material risk to long-term value creation.”

— EMEA / APAC Stewardship Analyst

“Companies with the worst ESG scores may rise in engagement priority. Our efforts will aim to address their gaps and track alignment with sustainable frameworks like PAI.”

— UK-based Investor

ENGAGEMENT PRIORITIES

What Are Your Engagement Priorities for 2025?

Investor engagement has significantly evolved during the past two decades, with a growing emphasis on both traditional governance and sustainable development. Historically, investors focused on fundamental governance issues, such as executive remuneration and shareholder rights, with the goal of ensuring accountability and aligning company performance with shareholder interests. However, the rise of climate change awareness and social concerns, especially after the Paris Agreement (2015) and the UN Sustainable Development Goals of the same year, marked a shift toward broader ESG topics.

As the understanding of sustainable risks deepened, investors began to integrate these issues into financial risk assessments, recognizing their material impact on long-term company value. Consequently, ESG factors became an important consideration, evolving beyond a non-financial lens into a comprehensive framework for risk management and sustainability.

Engagement priorities for 2025: evolving governance and sustainable focus

The survey results highlight four areas of enhanced focus for the 2025 proxy season: remuneration, shareholder rights, climate transition and human capital management. These areas reflect both traditional governance concerns and the rising importance of sustainability-related issues.

- Remuneration (83%): Remuneration is a main topic during annual meetings around the world. Many investors continue to emphasize the importance of aligning executive pay with long-term performance, especially in an economic environment shaped by some uncertainty. Investors seek to ensure that executive pay is fair, sustainable and aligned with long-term value creation. Companies will likely need to adopt a more nuanced approach to remuneration design and disclosure.

What Are Investors Saying? (Continued)

“Some funds are already setting engagement targets. Financial materiality remains a key driver, with thematic priorities like climate and human rights guiding our efforts.”

— Top 10 UK-based Investor

“Engagement isn’t just about targets; it’s about implementation. We expect companies to show clear, practical strategies to achieve their climate goals, focusing on actionable steps, not just aspirations.”

— UK-based Investor

- Shareholder Rights (79%): Shareholder rights have always been a core governance concern with the survey revealing growing attention from investors to protect minority shareholders and ensuring shareholder protections. Specific regulatory changes in countries such as the UK, Italy, Germany, and Switzerland, for example, new listing rules or adjustments to AGM practices, are prompting investors to focus on safeguarding shareholder interests. These developments highlight an evolving landscape of governance, whereby investors increasingly expect greater transparency and fairness in corporate decision-making processes.

- Climate Transition (75%): Climate transition remains a top priority as investors demand more than just aspirational commitments to climate action. They seek robust, transparent plans for achieving net-zero goals, including clear milestones, capital allocation, and alignment with science-based targets. As regulatory frameworks tighten and investor pressure increases, companies are expected to provide regular updates on their climate performance and demonstrate actionable progress toward decarbonization.

- Human Capital Management (71%): Investors increasingly recognize that human capital—encompassing workforce diversity, mental health, and employee well-being—directly impacts long-term value creation. The shift toward prioritizing human capital management underscores the importance of workplace practices in shaping a company’s success, innovation, and reputation. Investors are particularly focused on how companies attract, retain, and support talent, with an eye on equitable pay and labor practices amidst broader trends, such as workforce shortages and increased demand for flexible work arrangements.

Biodiversity, Cybersecurity, and AI

In 2025, investors will also engage with specific themes, such as biodiversity, cybersecurity, artificial intelligence (AI), and board dynamics, reflecting a sophisticated, holistic approach to risk management.

As investors recognize the financial implications of a healthy ecosystem, biodiversity continues to gain momentum, particularly in resource-intensive industries.

Cybersecurity, a perennial concern, remains critical as digital threats evolve, necessitating robust governance.

AI is a rapidly evolving technology that can be transformative, but which also poses many risks for companies. Investors are keen to understand how firms are currently using AI, and what their plans are to mitigate any risks.

Observations and Outlook for 2025

The results from our investor respondents reveal a clear shift in priorities, with a strong focus on integrating traditional governance concerns with strategic ESG goals. Investors are increasingly demanding measurable progress across key themes, from executive accountability and shareholder rights to climate action and workforce management.

In 2025, we expect engagement to evolve, reflecting investors’ demand for stronger corporate governance and remuneration plans that integrate sustainable principles into both strategy and operations. Many investors are no longer satisfied with high-level commitments and instead demand actionable plans and tangible outcomes that position companies for sustainable growth in a rapidly changing world. The growing emphasis on issues such as human rights, supply chain accountability, and climate transition shows that investors continue to broaden their focus, recognizing that these factors are integral to managing long-term risk and ensuring corporate resilience.

Looking ahead, these results suggest a trend toward more robust, accountability-driven engagement, with investors striving to ensure that companies are equipped to thrive in an increasingly complex and interconnected global economy.

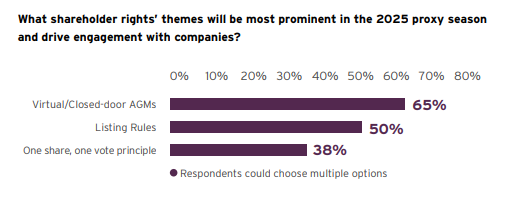

What Shareholder Rights’ Themes Will Be Most Prominent in the 2025 Proxy Season and Drive Engagement with Companies?

Shareholder rights have become a central focus for investors, especially as markets and companies adapt to evolving technological and governance landscapes. In the UK and Europe, changes in listing rules, the rise of virtual and closed-door AGMs, and the adoption of dual-class and loyalty share structures are reshaping shareholder engagement. Investors are increasingly vigilant about protecting their ability to influence decisions, seeing shareholder rights as vital for transparency, accountability, and fair access to influence.

Shifting Shareholder Rights

Historically, minority shareholder rights have centred on voting power, transparency, and the ability to participate in AGMs, which are key opportunities for them to influence corporate governance. The preference for equal voting rights and other market alterations have created some challenges for shareholder engagement.

Virtual and closed-door AGMs became common during the pandemic and continue even as restrictions eased. While some shareholders believe that virtual meetings enhance accessibility, others have voiced concerns that such meetings may reduce real-time engagement and spontaneity. Some commentators have raised concerns about closed-door meetings and in particular about the transparency and accountability of corporate decision-making.

Listing rule changes in markets such as the UK, Italy, and Germany are designed to attract high-growth companies but may dilute shareholder protections. For example, several shareholder organisations have commented that the UK’s proposal to simplify listing rules could lower governance standards and limit shareholder influence, whilst similar reforms in Italy and Germany involve trade-offs that may affect shareholder rights.

Dual-class and loyalty shares are gaining traction in European markets such as France, Italy, and the Netherlands. While proponents argue that these structures encourage long-term ownership, critics worry that they concentrate power in the hands of a few and marginalize minority shareholders.

Virtual and Closed-door AGMs

A significant 65% of investor respondents said they were focused on virtual and closed-door AGMs, highlighting concerns about accessibility and transparency.

Listing Rules

Half (50%) of investors said they were concerned about recent changes in listing rules in markets, including the UK, Italy, and Germany. These reforms aim to attract high-growth companies, with commentators suggesting that they may lower governance standards and compromise shareholder influence, particularly in the use of structures that limit shareholder voting power.

What Are Investors Saying?

“To maximize value, companies should engage early, seeking input on their strategies before publishing reports or finalizing proposals. Collaboration drives better outcomes for all stakeholders.”

— European-based Investor

“CSRD compliance is a massive challenge for companies. Our engagement will focus on understanding their progress and exercising patience as comparability and reporting standards evolve.”

— UK-based Investor

Equal Voting Rights

There is continued concern amongst investors about the rise of dual-class shares and loyalty voting rights, particularly in France and Italy. Whilst this issue is less prevalent than virtual AGMs and listing rules, 38% of investors emphasize the importance of equal voting rights, especially for minority shareholders.

Our survey results underscore how investors are prioritizing shareholder rights as a cornerstone of responsible corporate governance. Investors are signaling that fairness, transparency, and accessibility will likely be central to shareholder engagement in 2025. Virtual and closed-door AGMs, listing rules, and equal voting rights are particularly important as regulatory and market shifts continue to challenge the balance of power between shareholders and management.

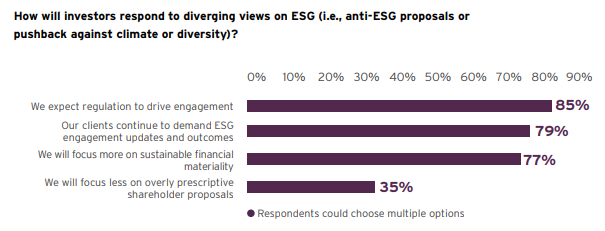

How Will Investors Respond to Diverging Views on ESG (i.e., Anti-ESG Proposals or Pushback Against Climate or Diversity)?

Once a niche consideration, ESG factors, driven by research on their connection to financial performance and rising stakeholder demands for responsible corporate behaviour, are now a fundamental part of investment risk and how investors assess long-term value.

However, the growing prevalence of anti-ESG proposals and pushback against issues such as climate action and diversity have introduced a new dynamic, challenging consensus around ESG priorities and creating a need to understand how investors may respond to these diverging views.

This has significant implications for how investors engage with companies on issues, including climate transition and board diversity. Regulatory and financial materiality now play a more prominent role in their decision-making.

ESG’s Rise and Diverging Views

ESG’s rise has been supported by key global regulations and frameworks, such as the EU’s Corporate Sustainable Reporting Directive (CSRD), investor-focused Sustainable Finance Disclosure Regulation (SFDR), and the Task Force on Climate-Related Financial Disclosures (TCFD). These initiatives have led to the standardization of ESG data and reporting. As a result, and along with effective engagement, investors can more easily integrate ESG considerations into their investment analyses. However, resistance to ESG, particularly in some US states, has created a divergence in regulatory policies. For example, some states have barred public pensions from considering ESG factors, viewing them as incompatible with financial returns. This contrasts with the EU’s approach, where ESG is firmly embedded into corporate and financial reporting frameworks.

Focus on Financial Materiality

A growing trend among investors is the focus on ESG factors with direct financial relevance, such as climate risk, governance quality, and human capital management. These issues are seen as having clear, measurable impacts on the financial performance and the long-term resilience of companies. However, the trend has caused a bifurcation: investors are more likely to engage on material ESG issues, or those with tangible financial outcomes, while non-material or regionally divisive topics may see slower adoption, particularly in the US. Despite some backlash, ESG’s overall momentum remains strong, but the emphasis is shifting toward more selective, performance-based engagement.

Investor Responses to Diverging ESG Views

The survey results highlight how investors plan to navigate the evolving ESG landscape, driven largely by regulatory pressures, financial materiality, and client expectations.

- Regulatory Compliance as a Key Driver: A significant 85% of investors expect regulation to be the primary driver of ESG engagement. This trend aligns with the global surge in ESG-related regulations, including the EU’s SFDR and Corporate Sustainability Reporting Directive (CSRD) and the SEC’s climate disclosure mandates in the US. Investors recognize the importance of aligning with these regulations to ensure compliance, which, in turn, results in enhanced ESG practices and disclosures.

- Focus on Financially Material Factors: More than three-quarters (77%) of investor respondents are prioritizing ESG issues that have clear financial relevance. This suggests investors are becoming more focused on tangible outcomes, reducing support for ESG initiatives seen as ideologically-driven or lacking direct financial impact.

- Clients Demand for ESG Transparency: The same proportion (79%) of investor respondents report that clients continue to demand updates on ESG engagement and outcomes, demonstrating that investor accountability remains a priority.

- Reduced Focus on Overly Prescriptive Proposals: 35% of respondents said that they would reduce their focus on shareholder proposals that lacked financial materiality. Investors are becoming more selective in their support of proposals, favouring those with measurable impacts on company performance. As a result, there may be greater scrutiny of ESG proposals at shareholder meetings, with an emphasis on clear, actionable outcomes rather than broad or ideologically driven mandates.

The survey results point to a pragmatic, materiality-driven approach to ESG, where investors are aligning their strategies with regulatory frameworks, financial performance, and client expectations. Key takeaways include:

- Selective Engagement: Investors are increasingly focused on material ESG factors, such as climate risks and governance issues that directly affect financial outcomes.

- Reduced Support for Non-material Proposals: Investors are becoming more cautious about supporting ESG initiatives that do not demonstrate clear financial relevance or may impose excessive operational constraints.

- Ongoing Client Transparency: Despite a more selective ESG approach, client demand for transparency ensures that investors remain accountable for their ESG engagements.

What Are Investors Saying? (Continued)

“Materiality is critical; ESG metrics must be relevant, stringent, and directly tied to the company’s strategy. Misaligned metrics, such as using climate goals in people-focused sectors, are red flags.”

— US-based Investor

“We value ESG metrics in pay when they align with financial materiality. They must address material risks, be quantifiable, and stretch goals – rigorous and defensible metrics are non-negotiable.”

— EMEA Stewardship Analyst

“Our focus is on materiality and alignment. Whether financial or non-financial, ESG metrics must be tied to real risks, deliver measurable impact, and provide clear value to shareholders.”

— Top 10 US-based Investor

“Too often, ESG targets are easy to meet, with 100% payouts year after year. This approach doesn’t incentivize meaningful progress or justify their inclusion in pay structures.”

— Top 10 UK-based investor

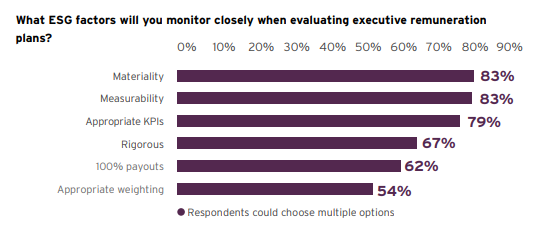

What ESG Factors Will You Monitor Closely When Evaluating Executive Remuneration Plans?

Many institutional investors are keen to emphasize ESG criteria when assessing how executive pay aligns with sustainability goals. The key question is which ESG factors should be prioritized in executive remuneration to ensure sustainable growth and stakeholder interests.

When asked to select the ESG factors that are most important when evaluating executive remuneration plans, of those who responded, 83% cited measurability and materiality as the top ESG considerations when evaluating executive remuneration plans. Most of these investors seem particularly concerned with ensuring that executive pay is linked to measurable outcomes directly relevant to the company’s long-term sustainability goals. These results therefore emphasize the need for compensation structures to be both data-driven and aligned with material ESG issues most likely to have the greatest impact on business performance.

What Are Investors Saying? (Continued)

“We don’t formally push for ESG metrics in pay. The focus is on questioning their inclusion—what metric, why that metric, and whether it truly aligns with the company’s priorities.”

— Top 10 European-based Investor

“ESG factors are increasingly tied to financial performance, and we are moving away from generic discussions. Companies must address these issues in a way that shows their financial materiality, or it will impact our voting decisions.”

— European-based Investor

Following closely were ‘appropriate KPIs’ (79%) and ‘rigorous evaluation’ (67%), indicating that investors expected ESG metrics to be based on well-defined performance indicators that can withstand scrutiny and demonstrate genuine progress towards ESG objectives. Investors appear to value transparency and rigor in how companies set, track, and report their ESG-related KPIs.

The importance of a ‘100% pay out condition‘ (62%) shows that investors are cautious about overpaying executives without clear and demonstrable ESG-related results. Remuneration that is tied to meaningful, tangible achievements seemed therefore to be a key priority.

More than half of respondents (54%) said that the ‘appropriate weighting’ of different ESG metrics should be balanced within the broader executive compensation packages. Whilst the topic received the lowest interest amongst the investors surveyed, it still receives significant attention.

Overall, the survey findings highlight a strong preference among institutional investors for executive compensation plans that are transparent, performance-driven, and tightly linked to material and measurable ESG goals. These priorities are shaping how investors engage with companies on ESG metrics in executive pay, reflecting a broader trend towards greater alignment between corporate leadership incentives and long-term ESG performance.

LOOKING FORWARD 2025

Do You Expect to Make Any Material Changes to Your Voting Policies for 2025?

To understand investors’ preparedness, we asked survey respondents whether they planned to update their voting policies for the 2025 season. The responses highlight their priorities and willingness to adapt to shifting market and societal demands, reflecting the broader trend towards more proactive and responsive governance practices.

- Review of Custom Policy Guidelines: A majority of respondents (58%) said that they intend to review their custom voting policy guidelines. This suggests that some investors plan to update their guidelines.

- Market-specific Changes: Approximately 38% of respondents intend to incorporate market-specific changes to their voting policies. For example, during the past few years, diversity has significantly influenced corporate governance and has become a key regulatory focus. As a result, some investors have incorporated or plan to incorporate changes in their voting policies, particularly regarding board diversity.

- Policy Review Without Material Changes: Approximately 31% of respondents said that they will review their voting policy guidelines but anticipate no significant changes. Most investors said that they had made significant changes during the last few years, and they are confident that existing guidance is sufficient. It’s also worth noting that most investors issue guidance, but given specific circumstances, such guidance may or may not apply to the company’s situation.

As the investment landscape continues to evolve, institutional investors increasingly recognize the critical role of governance in driving long-term value. Heightened scrutiny from clients, regulators and the public compel investors to align their voting policies with contemporary issues and responsible investment principles. The 2025 voting season presents a pivotal opportunity for investors to reassess and refine their engagement strategies.

Overall, many investors surveyed indicated that they are willing to consider reviewing (58%) or changing (38%) their voting policies. Proactive policy reviews reflect a commitment to governance that aligns with systemic risks and societal values. As changes to voting policies take effect, companies should prepare for increased engagement and demand for accountability

What Are Investors Saying? (Continued)

“Agenda setting is collaborative. For climate-related issues tied to a vote, we involve climate specialists and stewardship analysts to ensure we cover both environmental strategies and governance risks effectively.”

— Top 10 European-based Investor

“When governance risks are identified, we discuss them with portfolio managers, setting expectations for progress over time. If issues persist, it becomes a focus for closer scrutiny and potential escalation.”

— Top 10 UK-based Investor

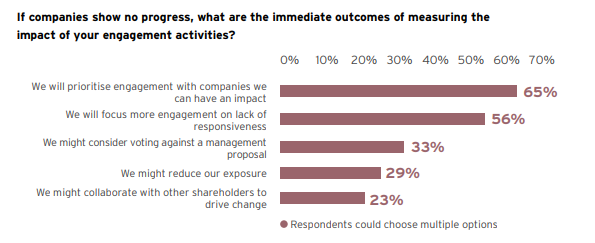

If Companies Show No Progress, What Are the Immediate Outcomes of Measuring the Impact of Your Engagement Activities?

When companies show no progress and they fail to respond, investors often plan to escalate their engagement with such companies and, in return, expect their efforts to have a measurable impact.

- Prioritize Impactful Engagement: Most investors (65%) will focus on companies where they see the potential for meaningful influence, such as optimizing the failing company’s resources for better outcomes.

- Address Unresponsiveness: More than half (56%) of respondents emphasize follow-ups as an action when companies remain unresponsive, reflecting a heightened demand for accountability and action.

- Vote Against Management: A third (33%) of respondents are prepared to vote against management proposals if progress is insufficient, signaling a more assertive governance stance.

- Reduce Exposure: Nearly a third (29%) of respondents may divest from companies that fail to address concerns, demonstrating a risk-averse and value-aligned approach.

- Collaborative Efforts: Almost a quarter (23%) of investors are open to joining forces with others to drive change, leveraging collective influence for greater impact.

A Strategic and Accountable Future

The survey results suggest that investors prefer companies to be thoughtful, accountable, and proactive in their engagement strategies. As more investors move from passive to active ownership, companies can enhance their responsiveness and transparency to align with their largest shareholders.

What Are Investors Saying? (Continued)

“Complex issues like climate transition may span decades. While we have escalation tools like voting, we also recognize the importance of measured, goal-oriented engagement over divestment.”

— US-based Investor

Trends and Implications

- Strategic Resource Allocation: Investors’ preference for impactful, effective engagement underscores a strategic recalibration. Investors aim to engage with receptive companies that can yield measurable change.

- Demand for Accountability: An emphasis on companies’ unresponsiveness highlights a rise in investor impatience. Companies that prioritize responsiveness will likely maintain strong investor relationships, particularly on ESG matters.

- Assertive Governance: A willingness to vote against management shows that investors are becoming more assertive, using their rights to hold management accountable for progress—or lack thereof.

- Risk Management Through Divestment: Reducing exposure to non-responsive companies reflects a broader trend of aligning portfolios with financial and ESG objectives, reinforcing investors’ commitment to sustainable practices.

- Collaborative Action: The rise in shareholder collaboration, Climate Action 100+, amplifies the influence of the collective and improves outcomes.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release