Early Filers: Bonuses Up Amid Flat Financial Performance

Key Findings

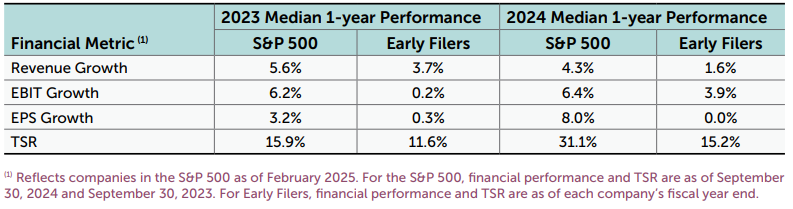

Performance: 2024 median financial performance – as measured by revenue, earnings before interest and taxes (EBIT), and earnings per share (EPS) – was generally flat and consistent with 2023 performance. In 2024, median revenue grew slightly (+1.6%), EBIT grew modestly (+3.9%) and EPS was flat (0.0%). One-year total shareholder return (TSR) was up double digits year-over-year (+15.2%).

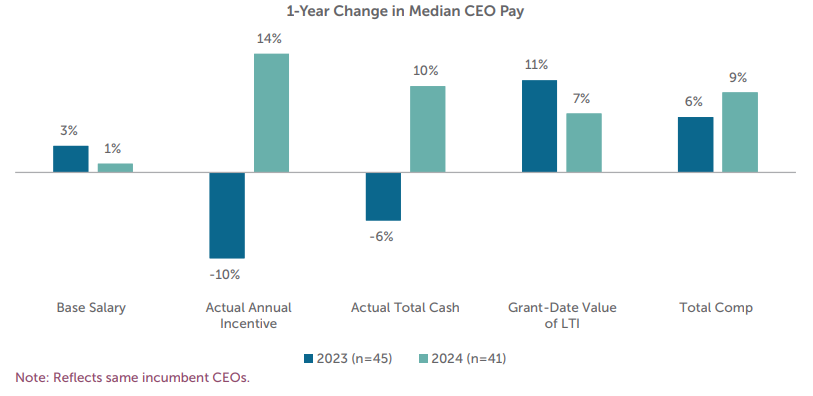

CEO Pay: Median CEO total direct compensation increased +9% year over year, driven by a +14% increase in actual bonus payout and a +7% increase in the grant-date value of long-term incentives (LTI).

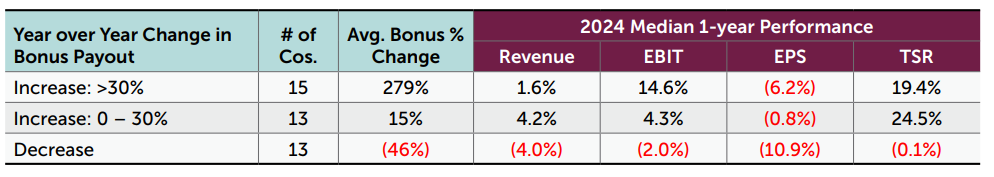

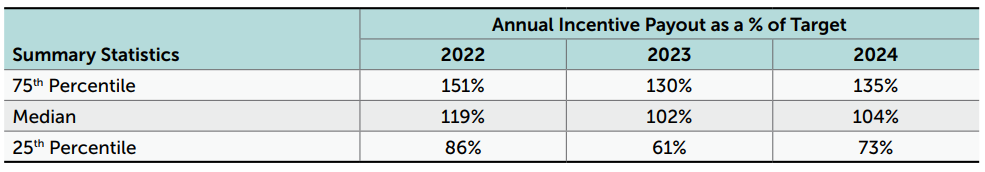

Annual Incentive Payout: For the second year in a row, median bonus payouts for CEOs were around target (i.e., 104% of target). Although financial performance was generally flat and annual incentive achievement was around target, CEO bonus payouts were up significantly. This is because, in general, companies with significant increases in bonus payouts (on average, approximately +280% increase) either rebounded from low payouts in 2023 or had continued sustained performance in 2024 and these increases were larger than the percentage change for companies that saw a decline in bonus (approximately 45%, on average).

2024 Performance

Financial performance for the Early Filers was generally flat for the second year in a row. Median revenue was up +1.6%, EBIT was up +3.9% and EPS was flat. In contrast, the S&P 500 experienced significant growth over the same period, fueled primarily by performance in the Financial Services and Technology sectors.

Median TSR performance continued to be strong among Early Filers and, for the second year in a row, was ahead of 1-year financial performance. At median, TSR was up +15.2% year over year. Macroeconomic factors, such as lower interest rates, easing of inflation and some improvement in the supply chain, impacted stock price results. The Technology sector saw significant increases given the advancements in artificial intelligence and related expectations for commercialization. One-year financial and TSR performance for the Early Filers underperformed the S&P 500, which experienced significant growth in 2024.

2024 CEO Actual Total Direct Compensation

CEO pay was up in 2024. Median total direct compensation – base salary plus actual bonus payout plus grant-date value of LTI – for the CEO was up +9%. This increase was largely delivered in the form of incentive compensation; actual bonus payout was up +14% and LTI was up +7% in 2024. LTI awards are generally approved in the first quarter (i.e., September 2023 – January 2024 for Early Filers) and increases in award value are typically to recognize strong company and/or individual performance from the prior year. Median base salary was generally flat (+1%) in 2024.

Although bonus payout continues to be around target (see Annual Incentive Plan Payout section), about one-third of the companies in our sample had significant increases in bonus payout year over year (on average, approximately +280% increase); some of the companies rebounded from 2023 performance while others had continued sustained performance. These increases were much larger than the declines for companies with lower bonus payout than prior year (on average, approximately -45% decline).

Annual Incentive Plan Payout

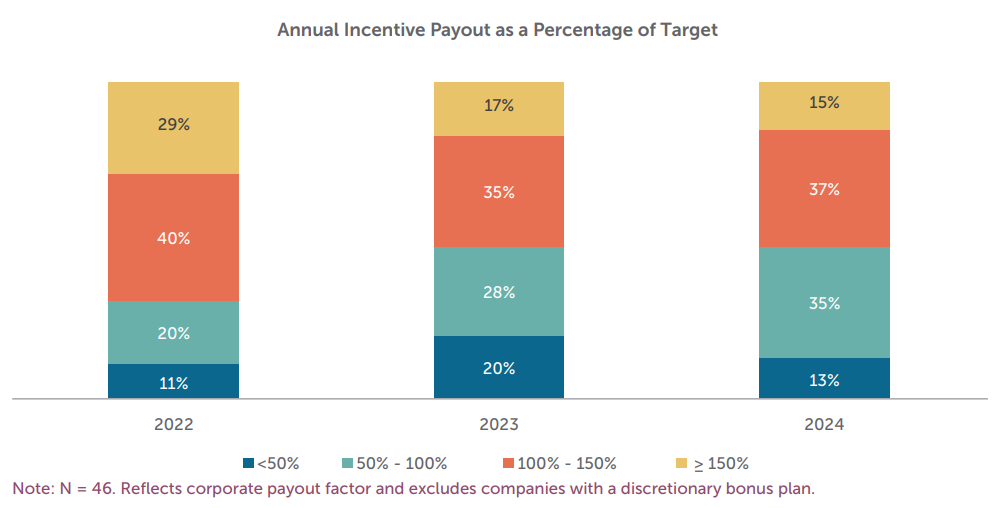

The median annual incentive payout was around target (104%) in 2024. Median and 75th percentile payouts as a percentage of target were consistent year over year. However, there was a modest increase in the 25th percentile bonus payout (73% of target in 2024 vs. 61% of target in 2023).

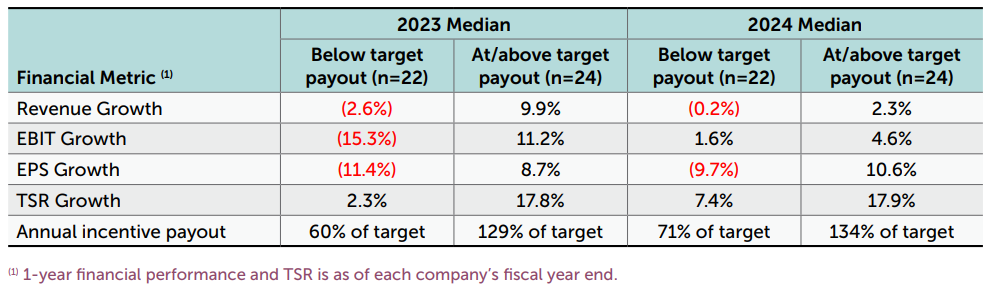

For the second year in a row, approximately 50% of companies in our sample had an annual incentive payout that was at or above target (median payout of 134% of target for these companies). While performance was robust for the “at or above target payout” companies, it was not as strong as 2023 performance. However, median payouts for these companies were higher than prior year.

For companies with below target payouts, financial performance was flat or down year over year while TSR was up modestly. Median payout for these companies was also up from last year (71% of target in 2024 vs. 60% of target in 2023).

Similar to last year, annual incentive payouts had a normal distribution though fewer companies had a payout below 50% of target in 2024 (13%) than in 2023 (20%). Three factors – the distribution of payouts, the median payout of 104% of target, and the significant increase in CEO bonus payout year over year – suggest that, even when a company provided a higher payout, it was generally within the same payout bucket as 2023 (e.g., if the payout was between 50% – 100% of target in 2023, it was likely between 50% – 100% of target in 2024).

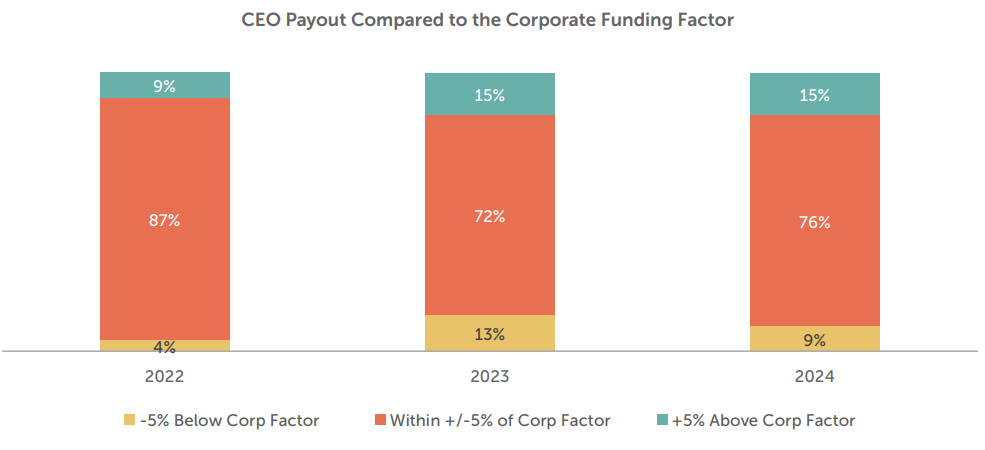

Approximately 75% of companies in our sample provided a payout to the CEO that was +/-5 percentage points from the corporate funding factor (i.e., the percentage at which the annual incentive funds based on company performance). If a company wanted to adjust an executive’s payout, as approximately 25% of the Early Filers did, there are a couple of ways in which it could be accomplished – through individual performance or discretionary adjustment. Less than half of the Early Filers use individual performance as a component of the annual incentive payout. Companies use individual performance to align the incentive payout with an executive’s contribution to the company and the results can raise or lower an executive’s payout relative to corporate performance. Companies can also make discretionary adjustments to recognize overall company performance (more broadly than incentive plan metrics). Similar to individual performance, these adjustments may raise or lower the bonus payout. Only a handful of Early Filers made discretionary adjustments in 2024.

Nearly 10% of companies reduced the CEO’s payout from the corporate funding factor in 2024. On average, companies that lowered the payout reduced it by 30 percentage points in both 2024 and 2023. The number of companies that increased the CEO’s payout was the same as last year (15% of companies). However, the average increase was somewhat higher in 2024 (23 percentage points) than in 2023 (16 percentage points).

Looking Ahead

2024 was a year of modest performance among the Early Filers, which resulted in around target bonus payouts at median. Some companies saw some improvement in financial performance, which resulted in a significant increase, overall, in bonus payouts year over year. Given the strong 2024 TSR performance, we would anticipate modest increases to LTI awards for the CEO in 2025.

There is uncertainty ahead for 2025 because of tariffs and continued geopolitical unrest. We anticipate that some companies will pass along the impact of tariffs to their customers while others may take a wait and see approach, particularly if the company’s industry is not significantly impacted. This macroeconomic uncertainty is already impacting TSR, which is slightly down since September 30, 2024; it is unknown the full impact tariffs will have on the economy and resulting company performance. Since tariffs are still being implemented with more proposed, as of the time of this publication, companies may or may not have incorporated the impacts of tariffs on incentive plan targets during the goal setting process. Therefore, companies should monitor the impact during the year and, at year end, ensure final incentive plan payouts align with overall company performance and the shareholder experience.

Early Filers’ Company Sample

CAP’s study reflects 50 companies with fiscal years ending between August and October 2024. Industry sectors reviewed include: Communication Services, Consumer Discretionary, Consumer Staples, Financials, Health Care, Industrials, Information Technology and Materials. Revenues for these companies ranged from $1.5 billion – $391 billion (median revenues of $11.9 billion); median fiscal-year-end market capitalization was $16.1 billion.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release