Labor Rights: Engagement Trends and Shareholder Proposals

As societies worldwide grapple with inequality, exploitation, and worker safety concerns, various stakeholders have increasingly engaged with companies on issues from workforce diversity and alleged labor rights violations to a range of practices and policies affecting employee safety and well-being. Increased engagement suggests significant discontent with the status quo and underscores the urgency of these issues for companies globally. In addition to regulatory, legal and reputational risks companies may face, their approach to labor rights issues can significantly influence the overall business landscape and ultimately affect investor returns.

For their part, many investors also seem to be taking more active steps to address related issues among investee companies. The number of shareholder proposals addressing various labor rights issues has increased significantly over the past five years, revealing ongoing concerns and a growing level of commitment among investors.

The concerns addressed in shareholder proposals range from company activities against workers’ freedom of association, child labor in the supply chain, alignment with international human and labor rights standards, living wage policies, worker safety, racial and gender pay equity, discrimination and harassment incidents to worker safety.

The following discussion explores some of the risks companies and investors face related to labor rights issues in the current operating environment and presents data on related shareholder proposals and voting trends, as well strategies investors may employ to engage with companies on labor-rights issues.

Addressing Labor-Rights Risks

For companies, failure to implement and enforce sound labor policies presents significant risks. One such risk is attracting regulatory scrutiny or action. In the U.S. for instance, filings to the U.S. National Labor Relations Board (NLRB) alleging unfair labor practices averaged 17,474 over the past five years, of which an annual average of 5,367 were settled by the parties. The NLRB itself also issued an average of 777 complaints annually. Settlements and resolved complaints led to an average outlay of $58.2 million annually in the U.S., most of which was backpay for the affected employees.

However, this sum is paltry compared to the legal risks from private suits and potential payouts and legal fees. Companies must disclose significant lawsuits and continuing liabilities regarding discrimination, workplace harassment and discrimination, fraud, and environmental, social, and governance violations, offering a glimpse into the scale of potential liabilities. Given how such risks may impact long-term company value, institutional investors are an essential stakeholder on labor issues, and are well-positioned to engage companies and boards on these issues.

Labor-Related Shareholder Proposals Since 2019

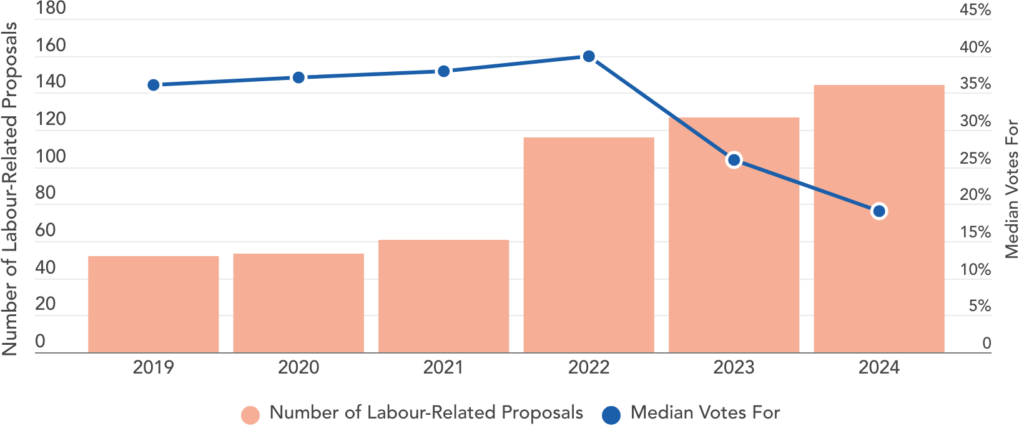

According to data from Glass Lewis, broadly defined labor-related shareholder proposals voted on at AGMs rose from 52 in 2019 to 144 through July 2024. Of these proposals, 74% focused on human capital management, compliance with international human and labor rights standards, and race or gender pay equity. On a percentage basis, the number of labor-related shareholder proposals rose by an average of 22.6% annually since 2019.

As the absolute number of proposals increased, median support for these proposals has settled at 19.2% in 2024 after peaking at 40.5% in 2022. The Conference Board observed that the decline in support likely stemmed from institutional investors shifting to scrutinize proposals individually, companies implementing ESG programs and reporting, and a decline in proposal quality or a clear link to shareholder value creation. As a result, proposals earning a majority of shareholder support crested in 2022, with 17 receiving more than 50% of the vote. None received majority support between January and July 2024.

Labor-Related Proposals and Median Shareholder Support

Source: Glass Lewis data

Of the 553 proposals voted on between 2019 and July 2024, 43, or 7.8%, earned majority support. While few garnered a majority of votes, shareholder concern did not disappear. 283 proposals, or 51.2%, received between 20% and 40% shareholder support. This level of shareholder dissent is noteworthy.

Labor-Related Proposals by Shareholder Support

Source: Glass Lewis data

Shareholder focus has honed in on human capital management issues. From zero proposals in 2019 to a high of 51 in 2024, these proposals are the largest group and account for 26% (144) of all labor-related shareholder proposals voted on at AGMs since 2019.

Human Capital Management-Related Proposals and Median Shareholder Support

Source: Glass Lewis data

Like the broader group of labor-related proposals, those focusing on human capital management received significant support in 2020 and 2021, 30% and 39%, respectively, with subsequent years revealing much less shareholder support.

Engagement on Labor Rights – Insights from Glass Lewis’ Stewardship Team

Engagement trends track closely with the increase in labor-related shareholder proposals, which is evidenced by the sustained support of these proposals. For one U.S.-based asset manager, the issue of human capital management accounts for up to 45% of their ESG engagements, and if DEI and labor rights are included, the percentage could reach as high as 69% (Source).

Investors may consider a number of strategies when engaging with companies on labor-rights issues. Firstly, investors may engage to ensure that investee companies comply with applicable national laws and regulations, and further advocate adopting policies that guard against discrimination and harassment based on protected statuses such as race, gender, and religion.

In addition, investors may inquire about an investee company’s human capital policies and programs. Firms with high turnover rates risk increased labor replacement costs, reduced productivity, decreased morale, and difficulty maintaining team cohesion and relationships.

Glass Lewis’ expert Stewardship team also has experience working with investors to navigate the terrain of labor rights issues. The team aids institutional investor clients in identifying and prioritizing material issues linked to financial performance and establishing engagement objectives. Engaging companies about diversity, inclusion, and pay equity, for instance, may help companies design policies and implement programs to reduce high employee turnover and related retention and morale risks. Glass Lewis’ Stewardship Solutions also support investors in leveraging frameworks, such as SASB and GRI, to structure the issues material to executives, shareholders, and other stakeholders.

In Glass Lewis’ Active Stewardship Engagement (ASE) program, 8.3% of ongoing engagements are addressing labor rights issues, with these engagements accounting for more than 6% of the companies in the program’s focus list. The most common issues revolve around employee well-being, worker safety, and grievance mechanisms (36.8%), transparency regarding audits of company policies and practices of worker rights (26.3%) and freedom of association and wages (15.7% each). One illustrative engagement under the ASE program focused on an airline in the U.S. Following a series of human capital-related controversies, a 2024 shareholder proposal requesting adoption of a non-interference policy received 25.6% support. Glass Lewis engaged with the company with the goal of disclosing a non-interference policy regarding freedom of association of employees. We have a scheduled call with the company in Q4, , and we will continue to engage on this issue. Read the full case study in the Q2 Active Stewardship Engagement

Glass Lewis also steers engagements conducted on behalf of investor clients to focus on core labor issues, such as wage fairness, freedom of association and collective bargaining rights, non-discrimination in hiring, and ensuring diversity in leadership roles. Such issues directly affect operational performance and reputation. Focused engagements also encourage companies to develop and deepen transparent disclosures on material labor issues and how they are addressed, with improved transparency benefitting all shareholders.

Mitigating Labor Rights Risks

Mitigating labor rights risks is crucial for companies to maintain the trust of employees, shareholders, fence-line communities, regulators, and other stakeholders. Consistent failure to do so could threaten a company’s social license to operate, expose it to various risks, and undermine long-term social value creation and profit generation.

Investors are essential in engaging companies to help them create social value and generate profits while empowering their labor forces. As evidenced by the flow of labor-related shareholder proposals and heightened public awareness of labor rights issues, these matters are unlikely to disappear soon.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release